Nov 22, 2022

China’s ‘Slow, Painful’ Reopening Threatens More Economic Strain

, Bloomberg News

(Bloomberg) -- China’s economy is bracing for major disruption into next year as coronavirus cases surge and challenge the government’s recent attempt to maintain Covid Zero but reduce the economic and social damage it causes.

The country is in for a “protracted and costly” reopening, with any release of pent-up demand likely to be lackluster as many households have already depleted their savings, according to Nomura Holdings Inc. economists. Hao Hong, chief economist at GROW Investment Group, said productivity is being hit as cities force residents to get regularly tested.

While the government is trying to avoid a hard lockdown like in Shanghai in the spring, a tightening of controls in some areas has already led to reduced mobility as consumers stay home. Economically important areas such as Guangdong, as well as cities including Chongqing or Beijing, are seeing a rapid rise in cases.

The path to reopening “may be slow, painful and bumpy,” the Nomura economists wrote in a note, suggesting a “back and forth” approach as rising cases stir reluctance among policymakers to ease curbs quickly. Nomura forecasts gross domestic product growth of 4.3% for 2023, lower than a median estimate of 4.9% in a Bloomberg survey.

Congestion levels in Beijing and Guangzhou fell last week from the week before, while congestion in Chongqing was down by about 28% week-on-week, according to Bloomberg analysis based on Baidu Inc data.

Business disruptions may also intensify. Foxconn Technology Group’s factory in Zhengzhou was hit by a Covid outbreak recently, prompting hundreds of workers to flee the manufacturing campus on foot.

Hao said the “gradual” reopening has caused fatigue within society and constant testing has damaged productivity.

“Most people are just fed up with it. and there are instances where people are starting to refuse to do the Covid test because it is quite arduous,” he said Tuesday in an interview on Bloomberg TV, noting that tests can be required as often as every day depending on one’s area of risk.

Hong added that some areas have reduced the number of available testing stations as well, which “creates a dramatic inconvenience and also a huge loss of productivity in the economy.”

Goldman Sachs Group Inc last week warned that growth in the first six months of 2023 would be weak before accelerating in the second half.

“In most western countries, economic activity accelerated almost immediately after reopening,” the Goldman economists led by Hui Shan wrote in a report. “In China, however, growth may soften during the initial stage of reopening, similar to the experience of several East Asian economies that previously implemented relatively tight Covid controls.”

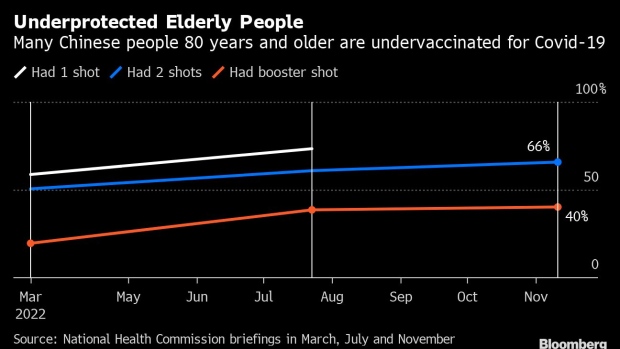

Reopening is likely to be slow as China grapples with the potential for deaths among the vulnerable elderly population, who are vaccinated at lower rates than in other nations. The three people in Beijing who died from Covid -- the first in around six months -- were all in their 80s and 90s, though whether they’d been vaccinated wasn’t made public.

Policymakers may be “concerned that China’s relatively poor medical resources may lead to a high number of Covid-led deaths,” the Nomura economists wrote, adding that China has a lower rate of hospital beds, ICU beds and nurses than places including Taiwan, South Korea and Japan.

©2022 Bloomberg L.P.