May 10, 2023

China’s Teapots Feast on Fuel Oil as Probe Hits Key Feedstock

, Bloomberg News

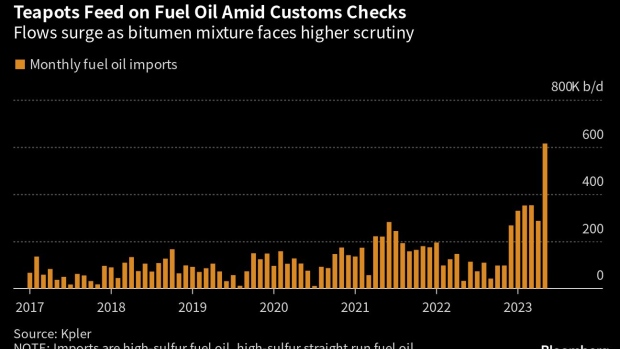

(Bloomberg) -- China’s smaller independent refiners have ramped up fuel oil purchases to feed their plants as a customs crackdown squeezes supply of another favorite feedstock.

Customs in Shandong province, the home to most of China’s private refiners known as teapots, started conducting quality checks on bitumen mixture last month that has crimped flows into the region, according to industry consultants and traders who participate in the market. It’s unclear why there’s increased scrutiny and authorities didn’t respond to a request for comment.

Bitumen mixture and fuel oil were the preferred feedstocks that teapots used to make products prior to Beijing granting them crude import quotas in 2015, and have been relied on to plug the gap when allocations fall short. Refiners were given a lower import allowance in the first batch for 2023.

China’s teapots have often come under scrutiny from Beijing but they’ve shown a knack for survival, at times exploiting tax loopholes to thrive. The current crackdown may force the refiners into buying expensive prompt cargoes of fuel oil or even lead to processing cuts, traders said, asking not to be identified because they’re not permitted to speak publicly.

Fuel oil flows discharged at ports in Shandong and Tianjin — another key region for nation’s teapots — were at a record 2 million tons last month, according to OilChem. Imports of bitumen mixture were at 500,000 tons, the lowest level since May 2020, the industry consultant said in a note.

Customs issues relating to bitumen mix led to nine tankers carrying around 10 million barrels of heavy oil anchoring off Shandong for at least three weeks recently, according to Emma Li, an analyst with Vortexa Ltd. A vessel would typically wait about five days to discharge a cargo.

The bitumen mixture label for a cargo has often been used to mask the origin of crude, such as Merey from Venezuela and more recently Iranian Heavy oil, according to traders. Customs figures show China hasn’t officially imported crude from Tehran since June 2022, however.

©2023 Bloomberg L.P.