Nov 16, 2022

China’s Top Oil Refiners Seek Beijing’s Aid to Keep Russia Flows

, Bloomberg News

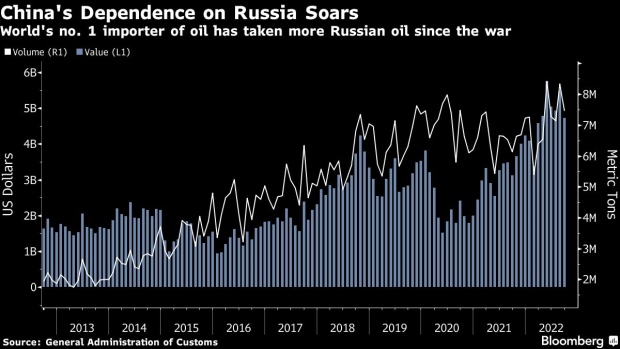

(Bloomberg) -- China’s largest oil companies are seeking help from Beijing to keep Russian imports flowing after new sanctions on Moscow that are set to kick in next month.

State-owned oil refiners are worried about their ability to work out the payment channels, logistics and insurance needed to keep buying from the OPEC+ producer after Dec. 5, said people with knowledge of the matter, who asked not to be identified as the information isn’t public.

Some solutions that have been floated include increasing the volume of Russian oil transported via pipelines, setting up a designated bank to handle payments and liaison with Moscow, and the use of more out-at-sea transfers to help with the challenges of direct shipments between seller and buyer, said the people.

Read about the logistical hurdles of handling Russian oil here.

With the European Union set to ban the financing, insuring and shipping of Russian crude in three weeks -- unless terms for exemption are met -- Asian importers are seeking workarounds that don’t involve banks, insurance clubs and shipowners from the bloc. The request for help from Chinese refiners reflects concern that unless they receive assistance, these companies could run into challenges keeping Russian crude flowing.

READ: How Will Insuring Russian Oil Work? ‘We Don’t Yet Properly Know’

It’s unclear if any of these options will be rolled out, they added. China’s Ministry of Commerce and Ministry of Foreign Affairs didn’t immediately respond to faxes seeking comment.

JPMorgan Chase & Co. had warned in July of a worst-case scenario of oil hitting a “stratospheric” $380 a barrel if western penalties prompt Russia to inflict retaliatory output cuts. More recently, however, President Biden stressed the importance of keeping Russian oil flowing to prevent a supply shock that would send prices soaring.

Janet Yellen said this week that Chinese and Indian imports of Russian oil were aligned with America’s goal. The US treasury secretary has been rallying support for an oil-price cap that would exempt Russian shipments from European sanctions, although details on the initiative remain scant.

Russia shipped 2.9 million barrels of crude daily in the seven days to Nov. 11, according to data compiled by Bloomberg. The volume of Russian crude heading to Asia hit 2.01 million barrels a day on a four-week rolling average basis, with China and India purchasing the bulk of supplies.

Workarounds

China -- the world’s no. 1 crude importing nation -- is no stranger to working with sanctioned regimes such as Iran, having persisted with imports from the OPEC producer and Venezuela’s state-owned oil company PDVSA despite trade restrictions imposed during the Obama administration.

The Chinese had used a local financial entity known as Bank of Kunlun to deal with Tehran, consolidating all activities under one domestically-focused entity that continues to operate after being slapped with US sanctions.

On the logistical front, the people said Chinese state refiners were worried about cargo and shipping insurance as large European companies start to distance themselves from the trade. They also highlighted challenges surrounding so-called re-insurance, which is the passing on of some liability from one insurer to another to help manage exposure to major claims.

In order to mitigate the hurdles, Chinese as well as Indian refiners can opt to procure Russian oil on a so-called delivered basis, leaving sellers to secure ships and insurance. Buyers can also buy oil at or below the price set by the US and its G-7 allies and comply with other terms of the Russian price cap, a policy that neither Beijing nor New Delhi have backed thus far.

--With assistance from Zhang Dingmin and Serene Cheong.

(Adds chart after 7th paragraph.)

©2022 Bloomberg L.P.