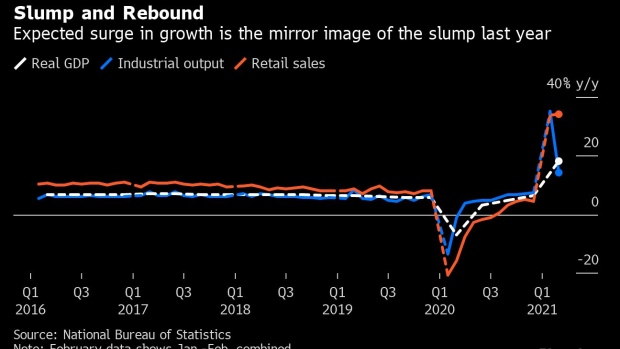

(Bloomberg) -- China’s economy is on track to return to trend growth after its V-shaped recovery from the coronavirus slump ended with a record pace of expansion last quarter, according to Goldman Sachs Group Inc.

“The economy appears to have passed a turning point,” Goldman Sachs Group Inc. economists including Hui Shan wrote in a note Tuesday. “Policy focus has also shifted from helping the economy heal from the COVID-19 downturn to addressing long-term stability and growth issues.”

China Joins U.S. as Engine of Global Recovery With Record Growth

The world’s second-largest economy expanded by 18.3% in the first quarter from a year earlier, when much of the country was shut to combat the coronavirus. Underneath the high rate of growth, there was a wide divergence across industries and an ongoing shift in growth drivers, according to Goldman Sachs.

Compared to 2019 to avoid distortions from last year’s activity collapse, exports and property sales are clear outperformers, while housing starts and manufacturing investment underperformed, the economists wrote. The performances are likely to show some convergence going forward, but at a slow pace.

While retail sales improved in March, the economists saw no strong signs of household consumption jumping higher in the near term with household saving rate remaining “stubbornly high” in the first quarter.

“With meaningful slack remaining, household consumption should play catch-up, but probably at a measured pace given the weight of uncertainties and the long way toward herd immunity,” the economists wrote.

China’s exports are also likely to see a shift in demand as the world economy recovers and reopens.

Demand for China-made personal protective gears is likely to soften, while non-Covid-19 related goods are expected to drive exports this year. The global housing boom and economic reopening can fully offset the negative impact of such declining demand for Covid-19 items, the research showed.

On the back of solid economic performance, Goldman Sachs expects the People’s Bank of China to keep the policy rate on hold and credit growth to decelerate moderately toward nominal economic growth by the end of the year.

With the sectors’ divergent performance, the government is expected to maintain necessary support for some areas while turning even more restrictive in others such as the property market.

©2021 Bloomberg L.P.