Jul 14, 2021

China’s more balanced recovery gives support to global rebound

, Bloomberg News

China's Economic Growth Slows to 7.9% in Second Quarter

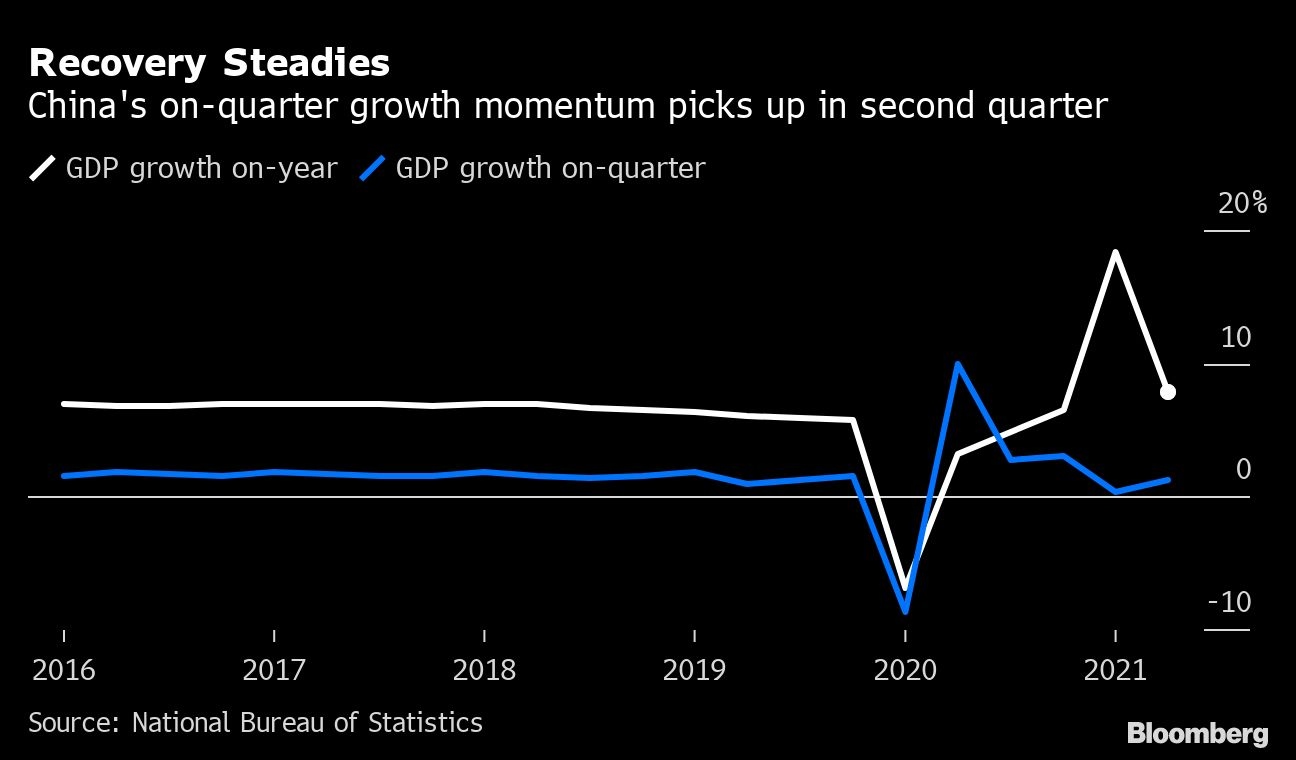

China’s economic rebound steadied in the second quarter and showed more balance as consumer spending picked up, providing support to a global recovery being shaken by resurging coronavirus cases.

Gross domestic product in the world’s second-largest economy expanded 7.9 per cent from a year earlier, the National Bureau of Statistics said Thursday, down from 18.3 per cent in the previous quarter, with that slowdown largely reflecting base effects from last year’s pandemic. On a two-year average growth basis which strips out that effect, the economy grew 5.5 per cent last quarter, slightly higher than in the previous three months.

A June pickup in retail sales and stronger investment by manufacturers fueled optimism that China’s growth is becoming more balanced after a V-shaped pandemic recovery which was fueled by surging exports and a hot property market, rather than consumer demand.

“The overall growth perspective is still pretty resilient,” Helen Qiao, chief Greater China economist at Bank of America Securities, said on Bloomberg Television, highlighting the accelerating pace of retail sales growth, which registered 4.9 per cent in June on a two-year average basis from 4.5 per cent the previous month. It’s a great surprise to see that people are still spending, she said.

The second-quarter data suggest Beijing can comfortably meet its growth target of more than 6 per cent for the year, and continue to drive global markets for commodities and industrial goods. Along with the U.S. and Europe, China has seen a rapid roll-out of vaccines this year with about half of its population innoculated, a milestone that should help sustain growth even as other Asian countries struggle with outbreaks of new virus variants.

Key Highlights

- Industrial output rose 8.3 per cent in June from a year earlier, beating the median estimate of 7.9 per cent

- Retail sales expanded 12.1 per cent in June; median forecast was 10.8 per cent

- Fixed-asset investment climbed 12.6 per cent in the first half from a year ago

- The jobless rate was unchanged at 5 per cent at the end of June

- GDP rose 1.3 per cent in the second quarter from the previous three months

The stronger-than-expected rebound in retail sales was supported by restaurants and catering services, which rose 2.6 per cent in June from the previous month. However, China’s production of steel and cement fell in June from the previous month, suggesting its economy might rely less on imports in the second half of the year, as it starts to rely more on consumer demand rather than commodity-intensive investment.

Growth is expected to slow slightly in the second half as consumers globally start to spend more on services, hitting China’s export sector. The People’s Bank of China last week made more cash available for banks to lend, raising speculation of a return to stimulus. But the bank confirmed its intention to keep monetary policy largely neutral on Thursday as it rolled over a portion of medium-term policy loans coming due.

“China’s June data alleviated concerns over a notable slowdown following last week’s RRR cut,” said Michelle Lam, Greater China economist at Societe Generale SA in Hong Kong. “Given the decent set of data, the recent policy shift seems to be pre-emptive, as downward pressure on growth should continue to build given the easing credit impulse.”

Market Outlook

The offshore yuan extended declines, falling 0.2 per cent to 6.4714 per dollar. 10-year government bond futures slid 0.37, the most since May.

What Bloomberg Economics Says...

We expect the authorities to continue to steer the economy toward a soft landing. In practice, this will entail balancing financial stability risks with the need to keep the recovery going, making minor adjustments to policy levers but no aggressive easing.

Chang Shu, chief Asia economist

Investment in China’s vast manufacturing sector strengthened in the first half to 2 per cent based on a two-year average from 0.6 per cent in the first five months of the year. Infrastructure investment slowed in the first half to 2.4 per cent on that basis, from 2.6 per cent in the first five months of the year, weighed down by the slow issuance of local government bond sales, while credit tightening for property developers curbed investment in the sector.

Chinese Premier Li Keqiang sounded a cautious note this week about the outlook, warning the nation needs to prepare for cyclical risks and make counter-cyclical adjustments. Analysts expect local governments will accelerate issuance of bonds in the second half to support infrastructure spending.

Beijing’s continued need to support growth in the second half sends a warning to the rest of the world about how durable their post-pandemic recoveries will prove to be and the dangers of exiting from stimulus prematurely. Group of 20 finance ministers recently highlighted the threat of new variants of the coronavirus and an uneven pace of vaccination as possibly undermining a brightening outlook for the world economy.

Not all analysts are convinced by the central bank’s statement that the cut in the required reserve ratio didn’t represent a change in policy direction, seeing greater monetary stimulus on the horizon.

Becky Liu, head of China macro strategy at Standard Chartered Plc in Hong Kong, said the economy needs more support and there could be more RRR cuts to come.

“China’s growth is decent, but it’s not good enough, and the economy will likely moderate further from here,” she said. “The market underestimated the central bank’s determination to ease monetary policy and support growth -- the RRR cut is an obvious signal that China has entered an easing cycle. RRR is never one off, and I expect the PBOC to reduce RRR again by year-end.”