Dec 9, 2018

China's Weekend Data Signal Weakening Demand at Home and Abroad

, Bloomberg News

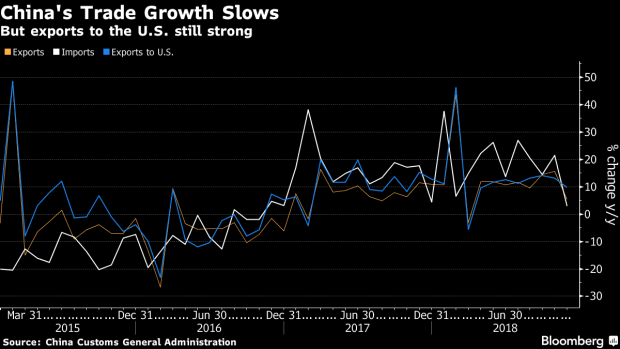

(Bloomberg) -- Economic data for China released over the weekend signal a further weakening of both domestic and international demand in November.

Factory inflation and the consumer price index slowed, while import growth slumped. Export growth also moderated, though the front-loading effect produced by tariffs still caused the surplus to the U.S. to hit a record.

- The producer price index climbed 2.7 percent in November from a year earlier, the slowest pace in more than two years. The consumer price index rose 2.2 percent, slower than estimated, according to data released Sunday.

- Exports in dollar terms rose 5.4 percent in November, the customs administration said Saturday, missing estimates. Imports grew 3 percent, widening China’s trade surplus to $44.7 billion from $34.8 billion. That was the highest this year.

Key Insights

- Weaker inflation adds to evidence that demand remains sluggish despite stimulus measures to cut personal income taxes and support private sector financing.

- Tame inflation gives China’s central bank some room for maneuver should easier monetary policy be required. The space is limited though, as the yuan is vulnerable to downward pressure.

- Expediting sales abroad ahead of expected tariff increases was likely still happening in November, as the U.S. tariff hike threatened for Jan. 1, 2019 was still on the table before presidents Donald Trump and Xi Jinping met during the Group of 20 summit.

- The tariff hike, which has helped spur export growth since August, was postponed after the high-stakes meeting last week, where both sides agreed to work toward a substantive agreement within 90 days.

- “Although the resumption of trade negotiations between China and the U.S. may reduce the risk of further escalation of trade friction, China’s domestic and external demand are under downward pressure,” Liu Liu, an economist at China International Capital Corporation Ltd wrote in a note. “China should also pay more attention to changes in domestic demand and policy responses.”

Get More

- Core inflation, excluding food and energy prices, remained stable at 1.8 percent

- The fall in global oil prices was the main driver of the slowdown in PPI inflation, according to Bloomberg Economics

- The trade surplus with the U.S. was almost $35.6 billion, driven by a 9.8 percent rise in exports compared with the same period last year and a 25 percent decline in imports.

To contact Bloomberg News staff for this story: Jeffrey Black in Hong Kong at jblack25@bloomberg.net

To contact the editors responsible for this story: Jeffrey Black at jblack25@bloomberg.net, Sharon Chen

©2018 Bloomberg L.P.