Oct 27, 2021

China’s Wind Giant Sees Demand Boom Resuming After 2021 Blip

, Bloomberg News

(Bloomberg) -- For China’s biggest turbine makers, 2021 may turn out to be a year of pause from a torrid pace of wind projects, judging by the bullish outlooks from both the industry and analysts.

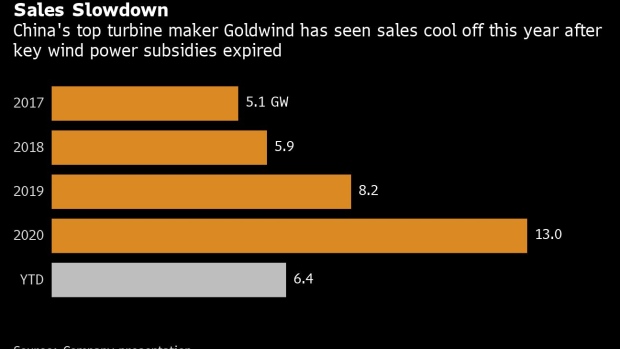

The sector has faced a sharp slowdown after delivering a record amount of new capacity last year to beat a deadline for government subsidies. Key incentives for onshore wind ended at the end of 2020, while offshore allowances lapse this year.

A weakening pace was clearly evident in the financial results of the country’s biggest turbine manufacturer, which late Tuesday reported an 11% drop in revenue for the third quarter. Xinjiang Goldwind Science & Technology Co. sold 6.4 gigawatts of turbines for the first nine months of 2021, compared with last year’s 8.3 gigawatts.

Yet the turbine business is expected to pick up as China and the rest of the world embrace renewable energy. Goldwind President Cao Zhigang said last week that wind installations will be on the rise in the years ahead, while the International Energy Agency projects demand for wind and solar globally will quadruple by 2030. The upcoming COP26 climate change conference may also help accelerate growth.

The optimistic outlook is being embraced by investors. Goldwind shares jumped as much as 10% Wednesday, extending a 12-month rally to 64%. Rival Ming Yang Smart Energy Group Ltd. gained as much as 8% to a record high.

While China is reeling in the subsidies that helped spur the installation boom, the government still aims to drive the industry’s growth as it ramps up efforts to reach its climate goals.

Beijing said this week it will accelerate the construction of large-scale wind power and solar bases, and set a target to have non-fossil energy consumption exceed 80% of its total mix by 2060. President Xi Jinping earlier this month announced a massive renewables project in the country’s vast deserts.

Read more: China Wind Giant Seeks Fewer Overseas Parts for Energy Security

Chinese companies have been leading the way in wind turbines, accounting for about 60% of global production. Goldwind supplied 13.5% of all installations last year, ranking just behind GE Renewable Energy and ahead of Vestas Wind Systems A/S, according to research by Bloomberg NEF.

Goldwind will see revenue increase faster than consensus, with growth accelerating in 2022-2023 due to COP26 commitments, domestic-policy measures and elevated fossil-fuel prices, according to a Bloomberg Intelligence analysis.

The company said it received 13.3 gigawatts of orders for the latest nine months, 1.9 gigawatts of which are from overseas, slightly down from about 14 gigawatts the previous year.

Goldwind is aiming to export around 2 to 3 gigawatts annually after 2021, up from about 1.5 gigawatts over the past few years. That would boost its share of the overseas wind market to 5% from 3%, Cao said in the interview last week.

©2021 Bloomberg L.P.