Feb 26, 2020

China’s Yuan Proves Resilient as Global Sell-Off Slams Peers

, Bloomberg News

(Bloomberg) --

China’s currency is showing strength against peers, despite the country being most affected by the novel coronavirus epidemic.

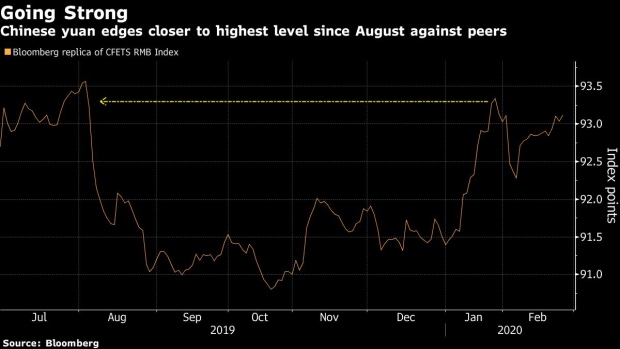

The yuan is approaching its strongest level since August versus a basket of 24 exchange rates, according to data compiled by Bloomberg. Most Asian peers have slumped against the currency in the past five trading days, with the Korean won and Thai baht tumbling nearly 2%.

While the yuan sank when China’s financial markets reopened after an extended holiday break in early February, the currency has stabilized in recent days. Government stimulus, a buoyant domestic stock market and figures showing a slowdown in new infections in the country have supported the yuan at a time when concern over the global spread of the disease is unnerving investors around the world.

“The markets had quite wrongly assumed this problem would be contained in China mostly, and recent developments are suggesting this is not going to be the case,” said Jeffrey Halley, senior market analyst for Oanda Asia Pacific Pte. “That has led to downward pressure on regional currencies as markets reprice the true risk. The yuan may outperform over the next month as the world plays catch-up.”

There were 78,064 confirmed cases of people infected with coronavirus in mainland China as of Tuesday, according to the National Health Commission, with 2,715 having died.

As China’s economy is expected to grow at its slowest pace in decades this quarter as efforts to stem the virus’ spread resulted in wide shutdowns, the government has announced aid including tax cuts and lower interest rates. Investor sentiment has been bolstered, with the CSI 300 stock index up 1.7% for February, versus a 3% drop for the S&P 500 in the U.S.

“China’s asset prices are showing signs of stabilization amid expectations of policy support and a decline in the rate of new infections,” wrote Citigroup Inc. Gaurav Garg earlier this week. The bank has recommended investors buy the offshore yuan against the euro as virus worries spread, especially in Italy. Garg predicts the CFETS yuan basket will climb to 95 in the near term, 2% above current levels and a point not reached since May.

But weakness looms longer-term for the yuan versus the dollar, according to Khoon Goh, Singapore-based head of Asia research at Australia & New Zealand Banking Group Ltd. “China’s stimulus measures and liquidity injections will not avoid a material negative impact on growth,” he said.

(Updates market levels in second and sixth paragraphs.)

--With assistance from Qizi Sun and Claire Che.

To contact the reporters on this story: Tian Chen in Hong Kong at tchen259@bloomberg.net;Lucille Liu in Beijing at xliu621@bloomberg.net

To contact the editors responsible for this story: Sofia Horta e Costa at shortaecosta@bloomberg.net, Kevin Kingsbury, Fran Wang

©2020 Bloomberg L.P.