Aug 5, 2019

China Signals No Surrender to Trump’s Latest Tariff Threat

, Bloomberg News

(Bloomberg) -- Want to receive this post in your inbox every day? Sign up for the Terms of Trade newsletter, and follow Bloomberg Economics on Twitter for more.

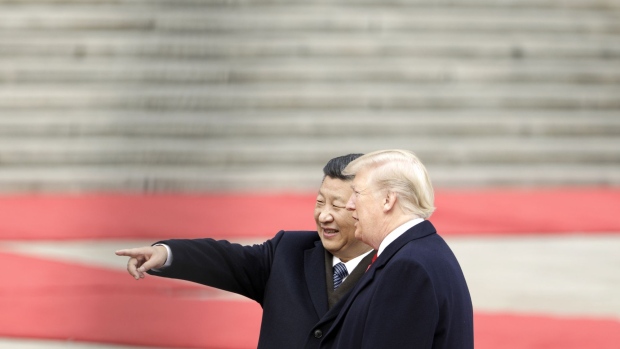

China wasted very little time in signaling on Monday that President Donald Trump isn’t the only one who can escalate a trade war. As the Chinese currency slumped below 7 to the dollar for the first time in a decade, officials in Beijing were telling state buyers to halt purchases of U.S. farm products.The clear signal: President Xi Jinping and his team aren’t planning to buckle under Trump’s latest tariff threats. If anything they’re sounding more than willing to call his bluff and play the long game. That’s one of several reasons the U.S.-China trade war casting a shadow over the global economy looks increasingly like it risks becoming the Forever War. Here are a few more:

- Neither the U.S. nor Chinese economies are suffering enough yet to force a deal. That may change. But with the Federal Reserve offering an implicit safety net for the U.S. last week and China’s leadership willing to weather a slowdown there, the economic pain appears to be short of any threshold.

- The bromance between Trump and Xi seems to be ending, with both signaling they see weakness rather than strength in the other’s domestic position. Trump seems convinced China’s economy is slowing more dramatically than it is and that it presents an existential threat to Xi even as he expresses frustration with Chinese policy makers’ willingness to pull levers to offset his attacks. Meanwhile, Xi is sending signals he is ready to wait until next year’s U.S. election and that he knows Trump’s political weaknesses. Ergo the move to cancel agricultural purchases Trump wants so dearly.

- Talks are going nowhere. A dinner at the Shanghai Peace Hotel for negotiators from both sides last week appeared designed to send a message to the outside world that a truce struck at the G-20 in June could hold. But the lack of progress in the room the next day prompted Trump’s tariff threat. Meanwhile, there are worries in both Beijing and Washington that Trump is now more focused on a mini deal involving purchases of farm products than a bigger, more meaningful pact.

Charting the Trade War

Samsung is already reeling from Japan’s export curbs on three key materials needed to make semiconductors. An expanded list that includes machine technology could make it even harder for Samsung and South Korean carmakers to make their chips and cars.

Today’s Must Reads

- Currency weapons | China’s move to let its yuan weaken to its lowest level in more than a decade opens up a potential new front for the world’s central banks: a currency war.

- Japanese cars | Sales by Japanese automakers in South Korea slumped 32% in July, after a trade dispute between two of Asia’s largest economies turned increasingly acrimonious.

- Europe’s view | An ECB article painted a grim picture of global trade prospects as downside risks to the outlook materialize, as tariffs hurt consumption and discourage investment.

- Ireland’s Brexit burn | The country’s biggest companies are getting a taste of the pain that could come from the U.K. crashing out of the European Union without a deal.

- Auto tariff joke | Trump joked with a European trade delegation gathered in Washington to announce an EU-U.S. beef deal that he was poised to impose crippling tariffs on German cars.

Economic Analysis

- China slowdown | Early indicators mostly point further weakness in the economy in July — before the trade war took another turn for the worse.

- Global fallout | An all-out U.S.-China trade war could deliver a $1.2 trillion hit to the world economy.

Coming Up

- Aug. 7: France trade balance

- Aug. 8: China trade balance

- Aug. 9: Germany trade balance

Like Terms of Trade?

Don’t keep it to yourself. Colleagues and friends can sign up here. We also publish Balance of Power, a daily briefing on the latest in global politics.

For even more: Subscribe to Bloomberg All Access for full global news coverage and two in-depth daily newsletters, The Bloomberg Open and The Bloomberg Close.

WhatsApp: Join us on WhatsApp to get news, insight and analysis of the day’s top stories. Sign up here.

How are we doing? We want to hear what you think about this newsletter. Let our trade tsar know.

To contact the author of this story: Shawn Donnan in Washington at sdonnan@bloomberg.net

To contact the editor responsible for this story: Brendan Murray at brmurray@bloomberg.net, Zoe Schneeweiss

©2019 Bloomberg L.P.