Jul 14, 2020

China Snaps Up Steel as Pandemic Creates Two-Speed Global Market

, Bloomberg News

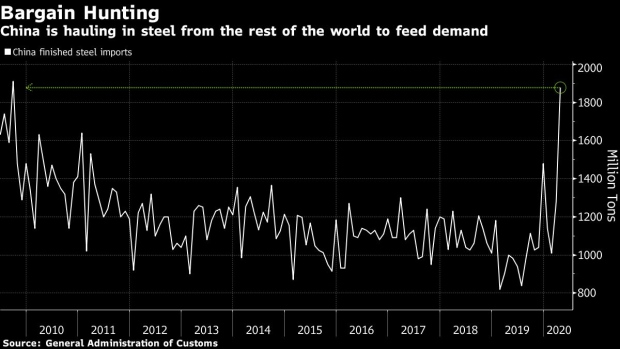

(Bloomberg) -- China’s steel buyers have pounced on cheap offers from around the world to feed buoyant demand at home, with flows to the biggest market reaching levels unseen since the global financial crisis.

Imports of finished steel products jumped last month to nearly 1.9 million tons, just short of the haul seen in September 2009. Then, as now, imports rose as a domestic recovery made it more profitable to ship in some products as prices languished on a global market still crippled by an economic collapse.

China’s domestic hot-rolled coil prices have traded at unusual premiums to international prices as the coronavirus pandemic ravages international demand. The World Steel Association expects China’s usage will rise 1% this year thanks to government spending on infrastructure -- in sharp contrast to the 17% decline predicted for developed economies.

China’s imports cover only a small portion of overall consumption. The nation remains the world’s biggest exporter of steel, although outbound volumes shrank last month to their lowest in eight years as external demand has cratered.

©2020 Bloomberg L.P.