May 27, 2022

China State-Backed Builder Rocks Bond Market With Extension Plan

, Bloomberg News

(Bloomberg) -- A Chinese property company long considered among the nation’s most resilient shocked investors with a proposed dollar-bond payment delay, raising fresh doubts about the financial strength of the industry’s higher-rated borrowers.

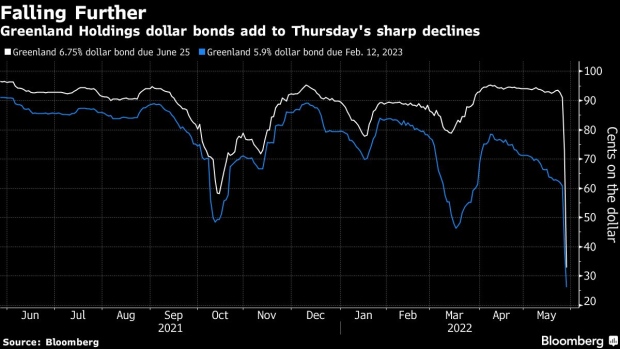

Greenland Holdings Corp., whose shareholders include the Shanghai government, is asking holders of a $488 million dollar note due June 25 to delay repayment by a year, a rare sign of stress at a state-linked firm. Its bond prices tumbled from highs of 92 cents on the dollar to record lows of 31 cents in recent days as fears of an extension were confirmed.

The proposal from Greenland, which has a presence in 30 countries, comes despite a flurry of government support measures aimed at ringfencing higher-rated borrowers. Policy makers have been stepping up efforts since March, cutting key interest rates and encouraging bond sales by some builders, though an absence of broader action has left some investors underwhelmed. Chinese Premier Li Keqiang last week urged local governments to “act decisively” on measures to boost growth.

Signs of stress at a firm like Greenland, China’s 11th-largest builder, is a worrying sign that even borrowers which enjoy some level of state backing may no longer rely on support when they run into trouble. The builder’s extension proposal “signals quasi state-owned developers aren’t immune to a liquidity crisis caused by prolonged Covid-zero lockdowns and heightened refinancing pressure due to market shutdown for weak developers,” wrote Bloomberg Intelligence analysts Dan Wang and Daniel Fan in a report.

SOEs, companies that are backed by local or provincial governments, have so far been spared from the credit crisis sweeping the real estate sector as authorities moved to clamp down on these debt-saddled borrowers. A payment failure at Greenland may prompt a drastic repricing of risk among state firms and “an onslaught of rating downgrades could happen and lead to systemic risk for the financial system,” Wang and Fan wrote.

Fears of contagion are resurfacing among other developers with state links as investors reassess the value of this support. Sino-Ocean Group Holding Ltd.’s dollar bond due 2025 fell 8 cents to 72.6 cents Friday, set for its biggest drop since November.

Avoiding Default

The nation’s builders have been scrambling to extend deadlines or exchange maturing notes to avoid an outright default as key channels of funding remain closed off to many builders.

Greenland is proposing a one-year extension on its 6.75% dollar bond due June 25 with an upfront payment of 10% of the outstanding amount, according to people familiar with the matter. That bond plunged a further 39 cents after tumbling 19 cents on Thursday, Bloomberg-compiled prices show.

S&P Global Ratings downgraded unit Greenland Holding Group Co. by two notches to B- this week and put the firm on watch for further cuts. It cited uncertainty over the developer’s ability to dispose assets and generate internal resources to repay offshore debt due the next three to six months. Moody’s Investors Service expressed similar concerns in its own downgrade earlier this month.

Lockdown Pressure

Greenland’s debt woes are also an indication of the economic damage and financial stress that China’s strict Covid lockdowns are causing struggling real estate firms.

The firm’s “business operations, financial performance and short-term liquidity have been adversely affected” by the recent spike in coronavirus cases in Shanghai and across China, as well as pandemic control measures such as lockdowns and travel restrictions, according to a Friday filing to the Hong Kong stock exchange. About half of its sales offices across the country have suspended business, it said.

©2022 Bloomberg L.P.