Jan 19, 2022

China Stocks Climb as Banks Cut Borrowing Costs After PBOC Moves

, Bloomberg News

(Bloomberg) -- Chinese stocks rose after lenders lowered borrowing costs following the central bank’s move to cut policy loan rates and commit to more easing.

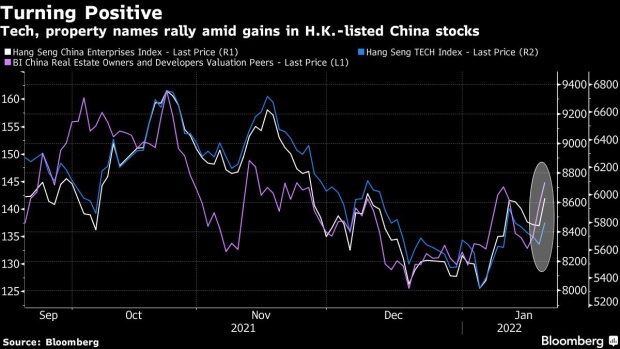

The Hang Seng China Enterprises Index rallied as much as 2.5% on Thursday, with property and technology shares among the biggest gainers. On the mainland, the CSI 300 Index jumped as much as 1%. Chinese sovereign bonds extended gains for a fourth day while the yuan was steady.

READ: Chinese Banks Cut Borrowing Costs as PBOC Signals Easing

Investors are turning more positive on Chinese equities as the central bank has pledged to use more monetary policy tools to spur the economy and drive credit expansion, even as the Federal Reserve looks set to hike interest rates in March. Growing bets that the worst of Beijing’s crackdown on internet giants is over have also helped boost sentiment.

A Bloomberg Intelligence gauge of Chinese real estate developers surged more than 4% as lenders cut the one-year loan prime rate by 10 basis points to 3.7% and the five-year rate by 5 basis points to 4.6%. Property names were also boosted by a report late Wednesday that Beijing is considering easing restrictions on access to pre-sale deposits held in escrow accounts.

The Hang Seng Tech Index jumped more than 3% on Thursday. It has started 2022 with gains after losing about a third of its value last year.

“We have been loading up on the low valuation sectors like property, banks, consumers as these may experience the greatest marginal boost from easing,” said Li Xuetong, a fund manager at Shenzhen Enjoy Equity Investment Fund Management Co.

The yield on 10-year Chinese bonds dropped modestly to 2.73%, close to the lowest level since May 2020, supported by expectations for additional easing from the central bank. Overnight repo rate, a gauge of borrowing costs in the banking system, fell 1 basis point to 2.03%.

The onshore yuan was steady as the central bank set its daily fix for the currency at the strongest level in three years.

©2022 Bloomberg L.P.