Mar 7, 2019

China stocks sink most in 2019 as rare sell rating stuns traders

, Bloomberg News

Chinese stocks tumbled the most in nearly five months as traders took a rare sell rating from the nation’s largest brokerage as a sign that the government wants to slow down the rally.

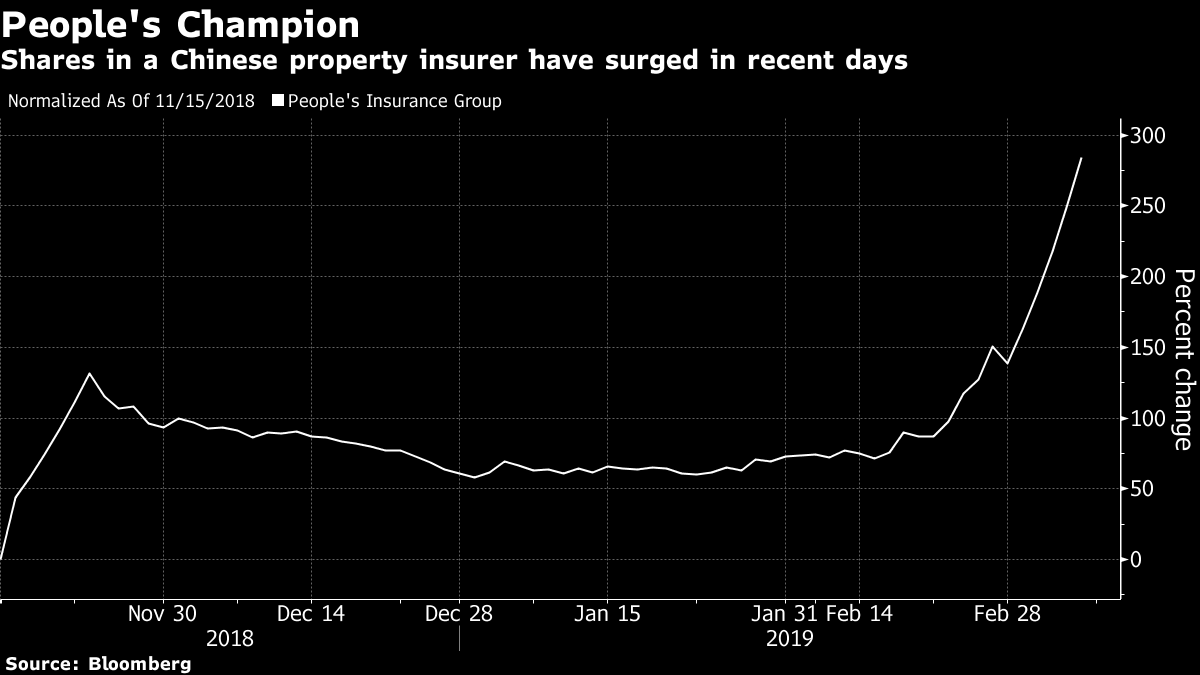

The Shanghai Composite Index lost 4.4 per cent to close below the key 3,000 point level. People’s Insurance Company (Group) of China Ltd., which had become a poster child of the ramp-up in equities, saw its A shares sink by the 10 per cent daily limit. Citic Securities Co. advised clients to sell the shares, saying they are “significantly overvalued” and could decline more than 50 per cent over the next year. The stock had surged by the maximum allowed by the exchange for five straight days.

"Such a sell rating must have been authorized by the regulators," said Yang Wei, a fund manager at Longwin Investment Management Co. "The stock market is overheating, there is too much speculation. Regulators want to see a slow bull market, not a mad bull market."

Chinese stocks have been unstoppable this year, gaining the past eight weeks to beat every other national market in the world. The government’s focus on economic growth, the new securities regulator’s less stringent take on financial risk and optimism over China’s relationship with the U.S. have combined to revive investor confidence. The US$1.8 trillion rally since January has been so fast it triggered signs of overheating in all of the country’s major benchmarks.

PICC Group listed in Shanghai in November, and the shares had almost quadrupled through Thursday to close at 12.83 yuan. The "rational" price is between 4.71 and 5.38 yuan, Citic Securities analysts including Tong Chengdun wrote in a note. PICC Group’s Hong Kong-listed shares, which trade at a discount of about 74 per cent, fell as much as 3.6 per cent Friday.

Goldman Sachs Group Inc. and JPMorgan Chase & Co. also have negative ratings on the yuan-denominated stock. The $65 billion firm, which was the first insurer to list on the mainland in seven years, had become the 11th most valuable company on the Shanghai Composite.

China’s new securities watchdog is removing many of the curbs designed to keep out speculators, signaling an end to the highly restrictive era that started when a boom in the country’s stocks turned to bust in 2015. The resulting appetite for risk has sent the ChiNext, Shanghai Composite, Shenzhen Composite Index and CSI 300 Index all into bull markets and triggered a surge in turnover not seen in years.

"The market in China can never find stability on its own, it’s either reaching for the sky or in the doldrums," said Dong Baozhen, a fund manager at Beijing Lingtongshengtai Asset Management. "The government needs to be very adept and subtle in its words to moderate the market. If they stay aloof, risks will pile up."

Losses extended Friday after trade data showed China’s economy was weaker than expected in February. Economists forecast both exports and imports would shrink, although not by as much.

It’s not the first time a specific stock has been targeted by the state. In November 2017, China’s official media singled out a rally in Kweichow Moutai Co., saying the shares should rise at a slower pace. The result was the liquor maker’s biggest one-day decline in over two years.

This time, it’s financial stocks which have been some of the biggest beneficiaries of China’s soaring equity market. Securities firms were among the biggest losers on Friday -- a Bloomberg index tracking the stocks slumped 9.2 per cent, paring its annual advance to 52 percent. Citic Securities fell by the 10 percent daily limit, the most on China’s large-cap gauge. Turnover on China’s exchanges totaled 1.18 trillion yuan (US$176 billion), the most since November 2015.

"This sell rating is like a depth charge for the market," said Lin Qi, fund manager at Lingze Capital. "The unwritten rule is that a securities firm will not be short on the market, much less single out a specific company. Given the size and importance of Citic Securities, such a move is significant."