May 16, 2022

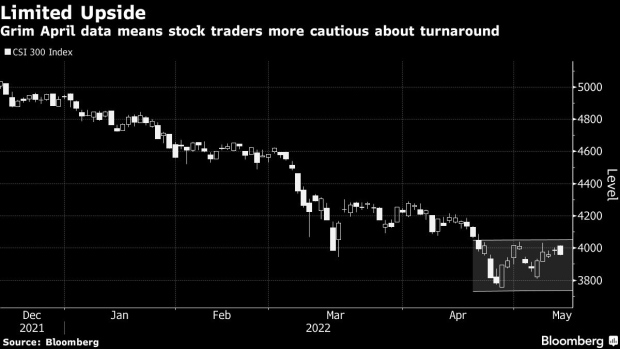

China Stocks Slip as Economic Data Disappoint, MLF Rate Held

, Bloomberg News

(Bloomberg) -- Chinese stocks retreated, erasing early gains, as disappointing economic data outweighed moves by authorities to boost the property sector and ease virus-related curbs in the financial hub of Shanghai.

The CSI 300 Index was down 0.5% as of 11:10 a.m. local time after climbing as much as 0.7% earlier. China’s industrial output and retail sales both contracted more than estimated in April, data showed Monday, and the central bank left the interest rate on one-year policy loans unchanged.

That offset optimism spurred by Beijing’s decision Sunday to cut mortgage rates for first-time homebuyers. A Bloomberg Intelligence gauge of property shares was up just 0.7%, versus an earlier jump of close to 3%.

“The mortgage rate cut will really have a limited impact on the sector and economic growth when expectations for policy stimulus for the sector are extremely high,” said Shi Junbo, fund manager at Hangzhou XiYan Asset Management Co.

While traders have viewed China’s commitment to its Covid Zero strategy as a key concern for its economy and markets, the announcement of a phased reopening of shops in Shanghai after a six-week lockdown failed to bring much cheer on Monday. In the first step toward a return to normal life, shopping malls, department and convenience stores and supermarkets will gradually resume operations from today.

The CSI 300 climbed 2% last week amid a global selloff, boosting hopes of a turnaround for the battered Chinese stock market. Down 20% this year, the benchmark is one of the world’s worst-performing major equity gauges this year, as a series of policy steps and vows of market stability from authorities since mid-March have only brought fleeting gains.

“There is also the argument that the economic bottoming out will be a slow and gradual process as the threat of lockdowns still lurks, even amid headlines on Shanghai’s restart,” said Li Xuetong, a fund manager at Shenzhen Enjoy Equity Investment Fund Management Co.

Still, “judging from the limited downside in the market so far, there are some who believe it’s possible we’ve seen the worst of it last month,” he said referring to Monday’s drop.

(Updates throughout)

©2022 Bloomberg L.P.