Nov 23, 2022

China Tech Earnings Beat Fuels Upswing Optimism

, Bloomberg News

(Bloomberg) -- China’s beleaguered technology sector may have finally turned the corner, if earnings from top firms are anything to go by.

Market watchers are growing increasingly upbeat about the sector’s prospects after a slew of top-line beats by industry behemoths such as JD.com Inc. and Baidu Inc. The conviction is growing even as players like Alibaba Group Holding Ltd. continue to grapple with lackluster sales growth. Notably, Bank of America Corp.’s Michael Hartnett is positive on Chinese stocks, and the firm named selling US tech stocks as one of its top trades for 2023.

Investors are looking to unearth potential buys in the sector after the authorities rolled back some virus curbs and expectations grow that a regulatory crackdown may be drawing to an end. Still, China’s tech firms remain far from a one-way bet as a new wave of Covid cases threatens to derail a recovery in consumption and investment.

“On the fundamentals side, I do think the worst is probably behind” them, said Vivian Lin Thurston, portfolio manager at William Blair Investment Management. “The growth of those companies may not be as strong as we saw in the last decade, but it’s still very solid and probably more favorable than other sectors within China. The investment opportunities are very interesting and attractive.”

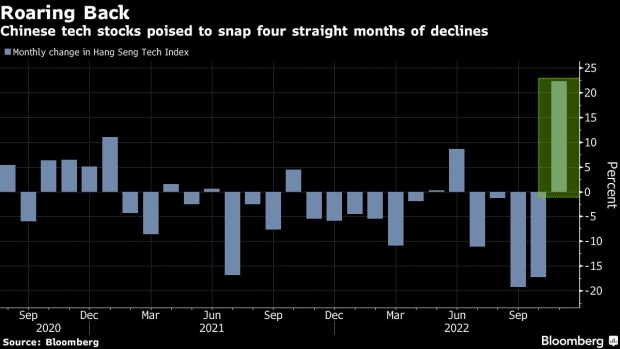

Optimists are calling a bottom in the sector after the Hang Seng Tech Index gained 25% so far this month, putting it on track for its first monthly advance since June. It rose 1.1% on Wednesday, though it remains down 37% for the year.

Among individual companies, US-listed shares of Baidu jumped 2.5% on Wednesday after the firm reported a surprise increase in revenue overnight. Similarly, Kuaishou Technology rallied 5.7% on the back of a better-than-expected sales report.

Of the 14 Hang Seng Tech member companies that have reported third-quarter results, nine posted sales that beat expectations.

Sentiment has improved amid speculation that a fine of more than $1 billion on Ant Group Co. may signal an end to the year-long crackdown on the sector. A loosening of some virus curbs has been another positive, as well as a thaw in US-China tensions and progress in US audits of Chinese firms.

Tech shares are also looking attractive following a slump in their valuations. Tencent Holdings Ltd. and Alibaba, for instance, traded at just 15 times and 8.8 times their forward price-to-earnings ratio, respectively, heading into the earnings season.

‘Cost Discipline’

Cost controls and new growth engines are key to separating the winners from losers, market watchers said.

“Some companies which had good cost discipline to face a slower economic growth environment resulted in good earnings growth,” said Pruksa Iamthongthong, senior investment director of Asian equities at abrdn. Firms with strong competitive advantages and better earnings visibility are best positioned for a recovery, she added.

Still, that’s not to say all the worries surrounding the sector have disappeared. A renewed surge in China’s Covid cases is fanning fears of stricter curbs while Beijing and Washington remain locked in a battle for leadership of the tech industry.

The Hang Seng Tech Index has retreated 5% this week to head for its first weekly drop since the end of October.

“I do feel that this sector has become more of a proxy of China macro and consumption stories,” said William Blair’s Thurston, adding that tech stocks may face more volatility in the near term depending on how China’s Covid situation evolves.

Tech Chart of the Day

Tesla Inc. has seen more than $524 billion in market value destroyed this year. The selloff in the electric-vehicle maker accelerated in November after Chief Executive Offer Elon Musk offloaded another chunk of his stake. The stock has slumped 25% this month, as of its most recent close, setting it up for its biggest monthly decline ever. Tesla has been facing a host of issues, from Musk’s shift in focus to turning around Twitter Inc. to China’s return to Covid Zero curbs. Shares in the company rose 2.9% on Wednesday, valuing the company at about $551 billion.

Top Tech Stories

- Hundreds of workers at Apple Inc.’s main iPhone-making plant in China clashed with security personnel, as tensions boiled over after almost a month under tough restrictions intended to quash a Covid outbreak.

- Walt Disney Co.’s Avatar sequel has been given a release date in China, according to people familiar with the matter, a boon in a key market for the entertainment giant as it looks to move beyond this week’s management upheaval.

- Tesla’s Musk said he considers South Korea as a top candidate for investment, according to the office of President Yoon Suk Yeol.

- HP Inc. will eliminate as many as 6,000 jobs over the next three years amid declining demand for personal computers that has cut into profits.

- Prosus NV plans to sell the stock in Chinese firm Meituan that it will receive from partly owned internet giant Tencent Holdings Ltd. -- boosting the e-commerce group’s cash pile as consumer spending weakens.

- China’s purchases of machines to make computer chips fell 27% last month from a year earlier as the US imposed new, sweeping sanctions to try and derail the country’s chip ambitions.

- Twitter CEO Musk is restoring a string of accounts previously suspended for harassing transgender people, rolling back protections for the LGBTQ community as the country confronts the aftermath of a shooting in a Colorado gay club that left five people dead and dozens wounded.

--With assistance from Subrat Patnaik, Ryan Vlastelica and Boris Korby.

(Updates to market open.)

©2022 Bloomberg L.P.