Sep 15, 2021

China Tech Falls as Macau Casino Curbs Stoke Fear of More Limits

, Bloomberg News

(Bloomberg) -- China tech stocks declined as government scrutiny on Macau casinos fueled concerns that Beijing was strengthening its regulatory crackdown. The country’s weakening retails sales growth also weighed on e-commerce shares.

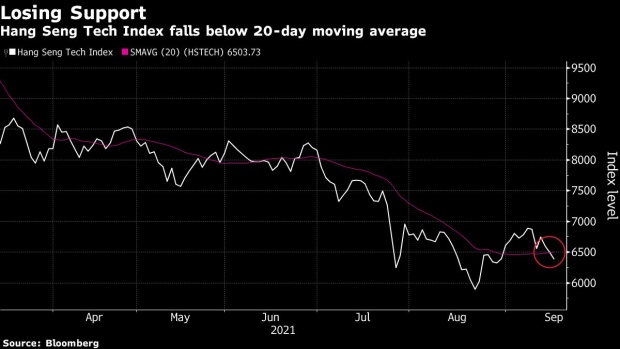

Hong Kong’s Hang Seng Tech Index slid by as much as 2.5%, on pace to extend losses to a third day, the longest losing streak in a month. The worst performers were Ming Yuan Cloud Group Holdings and JD Health International Inc. They fell by at least 7.1% each.

Casino stocks traded in Hong Kong slumped after Macau laid out plans to step up scrutiny of operators and increase local ownership, signaling tighter control over the world’s largest gambling hub. A Bloomberg gauge tracking casino shares slumped as much as 19%, its biggest on record.

“Regulation concerns are again on the top of minds given what has happened to Macau casinos,” said Daniel So, strategist at CMB International Securities Ltd. “Investors are worried that tightening policies will keep coming out to curb technology sector, hence we are seeing further declines.”

READ: Macau Casino Stock Gauge Plunges by Record on Tightening Rules

E-commerce giants Alibaba Group Holding Ltd. and JD.com Inc. lost at least 2.7% after China reported weaker-than-expected retail sales figures for August with consumers turning wary amid the Covid outbreak.

Also hurting the sentiment is a Xinhua report late Tuesday that China will accelerate the drafting and implementation of internet rules to protect minors also raised concerns. Tencent Holdings Ltd. and Kuaishou Technology fell by around 3%.

©2021 Bloomberg L.P.