Jul 1, 2022

China Tech Rally Sends Insiders Rushing for Exits: Tech Watch

, Bloomberg News

(Bloomberg) -- No one would have predicted it a few months ago, but Chinese technology stocks now are a rare pocket of strength in global markets. A wave of selling by corporate insiders is calling into question how far the rally can go.

JD.com Inc. insiders were net sellers of shares in May and June, the first back-to-back selling since November, Bloomberg-compiled data show. The major backer of Tencent Holdings Ltd. said this week it will further cut its stake, while SenseTime Group Inc. nosedived after cornerstone investors offloaded shares at the first opportunity since the artificial intelligence giant’s initial public offering in December.

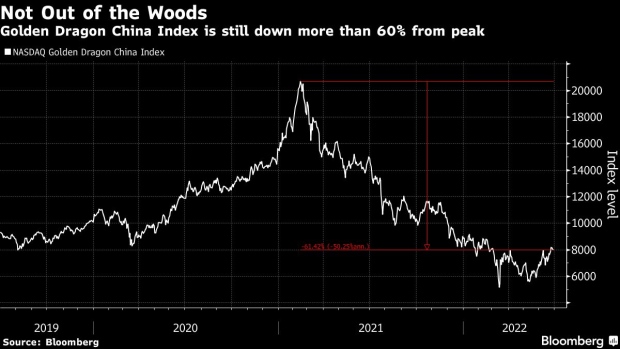

The divestitures add to the pressure on Chinese tech stocks after they staged a strong comeback from a multiyear trough thanks to a softening regulatory stance and an easing of Covid-19 restrictions. The Nasdaq Golden Dragon China Index of U.S.-listed companies this week is on track to post its first weekly decline since mid-May.

While insider selling isn’t always a bad sign, it’s closely watched as a barometer of shifts in the attitudes of presumably well-informed investors.

Insider selling “could be an overhang for some of the stocks in the near term and will affect sentiment,” said Jasmine Duan, investment strategist at RBC Wealth Management.

To be sure, a growing chorus of Wall Street banks and investors is turning more sanguine on China’s tech sector. China is the best place to buy in the sector right now because valuations in the US remain too high, the global head of asset allocation research at Invesco Ltd. said this week.

Yet some industry insiders have been painting a more downbeat picture, warning that the enormous growth rates of the past two decades aren’t coming back. The Golden Dragon gauge is still about 60% below its 2021 record even after the recent surge.

The regulatory uncertainty clouding China tech “hasn’t gone away, while valuations have clearly become very cheap, perhaps for a good reason,” said Sid Choraria, a portfolio manager at SC Asia.

To counter the negative impact of insider selling, some companies have also stepped up share buybacks. In the two days following major shareholder Prosus NV’s announcement of the planned stake sale, Tencent bought back 1.66 million shares, according to stock exchange filings.

Tech Chart of the Day

Alibaba Group Holding Ltd., the biggest company in the Golden Dragon index, has surged 46% since the benchmark bottomed in March. The rally ran out of steam in June, though, as the shares bumped into the 200-day moving average.

Top Tech Stories

- Micron Technology Inc. gave a surprisingly downbeat forecast for the current quarter after demand for phones and computers weakened, but vowed to move aggressively to stave off a glut of semiconductors.

- The Apple Inc. lawyer who was once responsible for enforcing the company’s insider trading policy admitted he used his access to draft SEC filings to personally profit.

- Elon Musk’s SpaceX won permission from US regulators to offers its Starlink broadband-from-space service to users in vehicles, vessels and aircraft.

- Oracle Corp., one of the largest US tech employers, has strengthened worker benefits for abortion access while remaining publicly silent on the issue.

- Amazon.com Inc., AT&T Inc., and Walt Disney Co. have said that they will help cover travel costs for employees who need care that isn’t available where they live. At the same time, state campaign-finance records show that the companies or company affiliates have financially supported leaders who are trying to reduce access to abortions.

- Apple raised the prices of its iPhones and iPads in Japan in an uncommon move to account for the yen’s precipitous drop in value this year.

- Google reached an agreement with US developers that will let consumers subscribe to services outside the company’s Play Store, marking the latest shift for an app-store economy that it dominates alongside Apple Inc.

- Uber Technologies Inc. said it received 3,824 reports of sexual assault and misconduct across five categories on its ride-hailing app in 2019 and 2020, reflecting a 38% decline in the rate of such reports since its first safety report published two and a half years ago.

©2022 Bloomberg L.P.