Oct 2, 2022

China Tightens Lending Taps, Leaving African Markets Vulnerable

, Bloomberg News

(Bloomberg) --

Developing countries in Africa are losing a champion that for years allowed them to borrow at cheaper rates than they could find in capital markets.

China, Africa’s largest bilateral creditor, has been scaling back lending in the region amid its worsening growth woes. That comes at a time of rising interest rates globally and shrinking liquidity, factors that have already sent bonds of the riskiest African borrowers such as Ghana and Zambia crashing, and currencies including South Africa’s rand to near pandemic lows.

The evolving debt dynamics with Beijing -- whose lending is focused toward long-term infrastructure projects -- threaten to push reluctant governments into the arms of the International Monetary Fund and World Bank for balance of payments support. Economic programs from the fund often restrict commercial borrowing, and require Chinese lenders to sit around the restructuring table with Western lenders.

“With shallow local markets, and thin policy and market buffers, Africa is going to need all the help they can get to smooth out the macro shocks which are buffeting them,” said Aninda Mitra, macro and investment strategist at BNY Mellon Investment Management in Singapore, who has covered EMs for more than two decades. “China’s reticence in debt restructuring and softening of its lending terms is bound to heighten vulnerabilities at these frontier economies.”

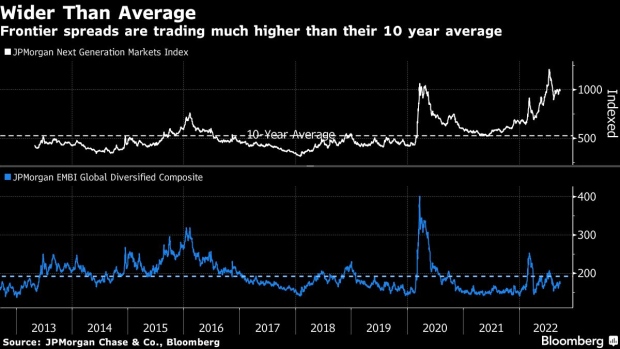

High-yielding bonds issued by frontier economies have been among the worst performers globally, with many already in distress before Russia’s invasion of Ukraine upended inflation and growth trajectories. Loss of market access, depreciating currencies and elevated energy and food costs are now heightening social and political tensions as well, according to analysts at JPMorgan Chase & Co. including Milo Gunasinghe and Amy Ho.

Yields on African dollar debt are at levels last seen during the global financial crisis levels after the Federal Reserve hiked interest rates in September and said it would do whatever it takes to get inflation under control.

Average yields on sub-Saharan debt jumped more than 100 basis points in the past week to trade at about 14.3%. That compares with the 50-basis-point increase for the emerging-market average to 8%. With China stepping away, heading to international bond markets may be the only option to get financing -- but for some, that’s becoming prohibitively expensive.

“US dollar strength, high commodity prices, higher US rates, quantitative tightening are making it significantly more challenging for frontier markets to roll over their maturing debt, or to fund their budget deficits,” said Gergely Urmossy, a London-based emerging-market strategist at Societe Generale SA. “Covering their hard-currency needs, for example to plug the current-account deficit, is another major challenge.”

From 2000 to 2020, the top 10 African government recipients of Chinese loans were Angola, Ethiopia, Zambia, Kenya, Egypt, Nigeria, Cameroon, South Africa, Republic of Congo and Ghana, according to data from the Boston University Global Development Policy Center.

Of those, Ethiopia has been flagged by JPMorgan Chase & Co. as carrying high repayment risk, and under threat of reserve depletion by the end of 2023. Zambia, which is in default on its eurobonds, and Ghana have approached the IMF for bailouts that may involve debt restructuring, while Egypt is seeking a new loan.

China is Zambia’s biggest creditor, accounting for almost 75% of bilateral borrowings, and is co-chairing a committee negotiating a debt restructuring after the country became Africa’s first pandemic-era sovereign defaulter in 2020. President Hakainde Hichilema had criticized the cost of Chinese projects before he won power last year, and has since forged closer links with nations including the US and the UK.

For the ongoing creditor talks in Zambia and Ethiopia -- seen as test cases for the Group of 20’s Common Framework template -- bondholders are waiting to see what other lenders, including China, agree to. The borrowers will need to seek comparable treatment from private creditors.

“Unfortunately, where Chinese lending has played a big role and debt default negotiations have begun, China’s large role has complicated the negotiations, and both Ethiopia and Zambia are still some distance from resolving their problems,” said Charles Robertson, global chief economist at Renaissance Capital Ltd. “China tends to prefer long extensions on debt and no cut in principal, but that doesn’t look realistic in every case.”

Robertson said China’s scaling back would slow growth in the region and “can’t be welcomed by most debt investors.” In the early years of Chinese lending to Africa, just 25% of countries were at high risk of debt distress, with sovereign spreads higher than 1,000 basis points. That proportion has grown to 60%, he said

Countries that have made progress with the IMF this year include Kenya and Mozambique.

“Those countries that succeed in greater engagement with the IMF will most likely not be that negatively affected by China’s disengagement,” said Jacques Nel, head of Africa macro research at Oxford Economics. “However, those that are unable to move closer to the IMF and World Bank but with big funding gaps might find it difficult to cope without cheap Chinese funding.”

What to watch this week:

- Brazilian assets jumped after President Jair Bolsonaro fought his way through to a runoff election against Luiz Inacio Lula da Silva on Oct. 30, as investors cheered on the incumbent’s better-than-expected showing and bet his leftist challenger will be forced to moderate his stances in the second stretch of the race.

- Israel and Peru will probably raise interest rates. Sri Lanka, which is in debt-restructuring talks with international creditors, is set to keep borrowing costs unchanged

- Turkey will likely say on Monday that annual inflation quickened further in September after exceeding 80% the previous month, exacerbated by the central bank’s rate cuts

- Elsewhere, inflation data from Indonesia, Colombia, the Philippines, South Korea, Thailand, Mexico and Russia may offer clues on the outlook for their monetary policies

(Adds charts on Africa loans, Ethiopia debt)

©2022 Bloomberg L.P.