May 26, 2020

China Traders Are Buying Hong Kong Stocks Like Never Before

, Bloomberg News

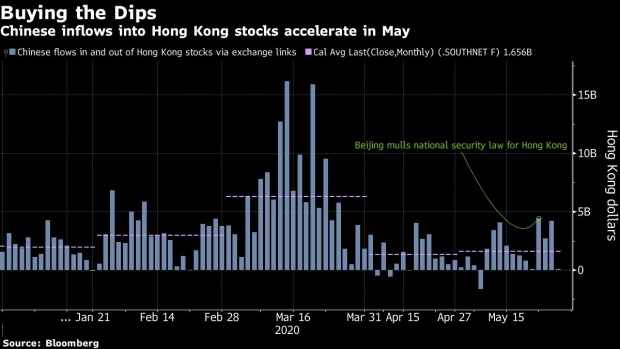

(Bloomberg) -- Mainland money is flowing into Hong Kong’s stocks at an unparalleled pace, offering support to a market at the center of rising tensions between Beijing and Washington.

Eligible investors, which can range from brokers to insurers or individuals with at least 500,000 yuan ($70,000) in their trading accounts, acquired $35.3 billion of the shares so far this year, the most for the period in data going back to 2017. Buying accelerated as Beijing’s plan to impose a security law on the city sparked an equity crash on Friday. The top targets of inflows were Chinese state-owned firms.

History shows mainland buying tends to pick up when Hong Kong shares drop. Onshore investors bought the dip in March when the Hang Seng Index fell to its lowest in more than three years. State-backed funds have also stood by to help steady Hong Kong’s markets around key political events, such as in 2017 when Xi Jinping visited the city to mark 20 years of Chinese rule.

Nervousness is building in Hong Kong’s financial markets after China confirmed plans for new national security laws that critics say would curtail the rights and freedoms of the city’s citizens. The U.S. is considering a range of sanctions on Chinese officials and businesses in response, as well as whether to declare that the former colony has lost its autonomy from Beijing. Protests are planned in Hong Kong for Wednesday.

Hong Kong equities stabilized Tuesday, with the Hang Seng rebounding 1.9% and a gauge of volatility dropping 5.6%, the most in a week. The city’s chief executive, Carrie Lam said Tuesday that the national security law can bolster business confidence, citing the Hang Seng rebound. She added that concerns over the law are unwarranted.

Chinese investors now own about 2.9% of the total market value of Hong Kong stocks eligible for cross-border trading, the highest since Hong Kong exchange data became available in March 2017, according to Bloomberg calculations. Chinese buyers’ top three targets since Friday’s slide have been Industrial & Commercial Bank of China Ltd., Ping An Healthcare and Technology Co. and China Construction Bank Corp., according to data compiled by Bloomberg.

It’s unclear whether China’s state-directed funds have been involved in recent days’ buying or whether they earmarked any cash to stabilize the market. Such funds have regularly intervened to manage swings in China’s $7.4 trillion equity market, especially around politically sensitive dates.

Some onshore money managers say they are taking note of a widening valuation gap with yuan-denominated shares, mainly focusing on large financial companies.

“As long as we stick with Hong Kong-listed companies with businesses on the mainland, the risks are completely manageable,” said Du Kejun, a partner at Beijing Gelei Asset Management Center LP. “It’s hard to evaluate what the impact of the law will have on the island, and if things will be better or worse than a year ago. I’d stay away from Hong Kong landlords and other locally based companies.”

The MSCI Hong Kong Index, which unlike the Hang Seng Index doesn’t include mainland firms, has fallen 21% in the past 12 months, led by real estate firms.

One of the main attractions of Hong Kong stocks for mainland investors is low valuations. The Hang Seng China Enterprises Index of Chinese firms listed in the city trades at eight times the next 12 months’ projected earnings, compared to 11 times for the Shanghai Composite Index.

Chen Jiahe, chief investment officer of the family office firm Novem Arcae Technologies Co., said he wanted to buy more Hong Kong-listed Chinese stocks last week but ran short of funds.

“We actually had to sell some of our A-share holdings to buy Hong Kong stocks,” he said. “And we’ll buy more if the market declines further and reinvest all dividends.”

(Adds comment in fifth paragraph and data in sixth paragraph, refreshes chart.)

©2020 Bloomberg L.P.