Nov 29, 2022

China Traders Prep for Watershed Moment on Reopening: In Charts

, Bloomberg News

(Bloomberg) -- Markets across China are cheering after officials vowed to speed up Covid shots for the elderly and to avoid excessive restrictions, possible signals that Beijing is heeding pressure to reopen.

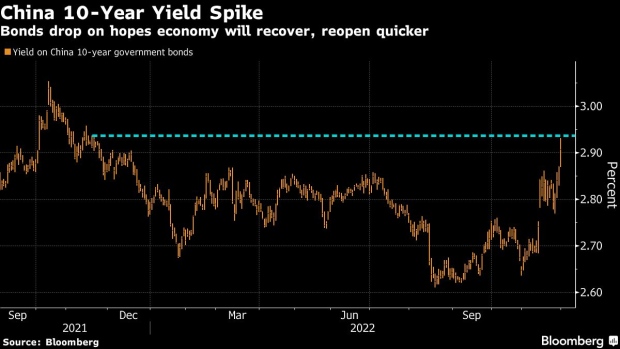

Government bonds sold off on bets that the economic outlook improves in a reopening scenario. Expectations for further monetary policy easing are abating. Yields spiked to the highest level in a year.

MSCI’s index of Chinese stocks is poised for the best November in 23 years.

A Bloomberg gauge of property shares is up 60% this month, on track for a record monthly advance. Regulators ended a ban on local share sales by listed property developers, which helped to boost the sector.

This is a traders’ market with offshore yuan volatility spiking to a record in November.

China’s demographic challenge will be in focus after Beijing vowed to speed up Covid shots for the elderly, which is seen as a critical step toward allowing the nation to abandon its Covid Zero policy.

Metro traffic is either at or near the lowest since the pandemic started in some major cities like Guangzhou and Chongqing. China’s iPhone city, Zhengzhou will end “mobility management” and return to normal anti-virus rules Wednesday.

Stimulating credit demand will be policymakers’ next challenge. Depressed interbank rates signal problem is demand for money in China and not supply of it.

©2022 Bloomberg L.P.