Sep 24, 2022

China Traders See Property Boost, Covid Zero Resolve at Congress

, Bloomberg News

(Bloomberg) -- Bruised from a tumultuous year, China stock investors are looking to capitalize on any potential policy shifts at the twice-a-decade Communist Party congress next month.

A key strategy is to bet on more stimulus for the property market as authorities seek to rescue the ailing industry. Bloomberg Intelligence expects some steps to complete stalled housing projects following the Oct. 16 leadership gathering, which can in turn support the banking sector by reducing loan risks and boosting mortgage demand.

With expectations low for an imminent shift away from the Covid-Zero policy, some investors are limiting their exposure to reopening shares. Societe Generale SA favors industrials and infrastructure stocks over consumer shares ahead of the event.

“There is going to be more support for the property sector because if the property market does not stabilize, the economy will not stabilize and growth protection is the number one policy priority,” said Chi Lo, senior market strategist for Asia Pacific at BNP Paribas Asset Management.

China stock gauges last week added to what have already been some of the world’s worst losses this year, as the Federal Reserve dealt global markets a hawkish blow.

Having grappled with Covid lockdowns, a property market downturn and Beijing’s conflict with Washington over trade and political issues for months, investors are hoping for the market to recover once the leadership reshuffle is complete and policy priorities are settled.

READ: China Stocks Face More Grim Milestones as Fed Deals Fresh Blow

Property Bets

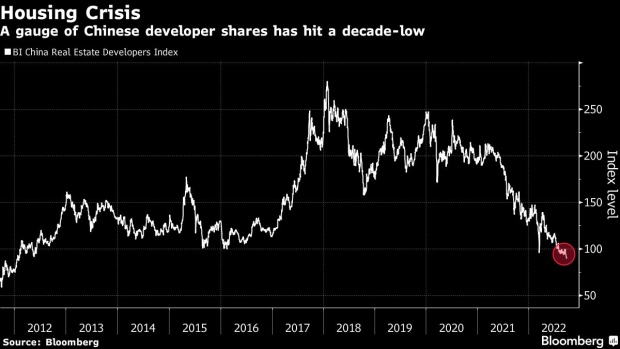

China’s vast real estate sector is going through an unprecedented crisis as Beijing’s deleveraging campaign since late 2020 has ensnared even the nation’s largest developers. A stock gauge of developers has lost more than 30% this year, despite dozens of measures to revive demand including loosening home-purchase restrictions.

READ: China’s CCB to Set Up $4.2 Billion Fund to Buy Properties

Consumer sectors related to the real-estate market may see positive impact, according to Li Jin, vice managing director at Ruiyi Investment. Furniture and decoration materials have led declines in retail sales this year, slumping at least 8% in August from a year earlier.

Sector-wise, past experience shows financials, food and beverage, communication, and defense sectors have beaten markets in the month ahead of the event, Li Xing, an analyst at Yuekai Securities Co., wrote in a Sept. 18 note.

Covid Zero

Overall, any boost to the broader market from the Party congress is expected to be modest, several analysts have said, amid slim odds of an early loosening of Covid restrictions.

The MSCI China Index has typically generated about 2% returns in the month before the congress in the past, according to Goldman Sachs Group Inc. strategists, who are unsure the gains can be repeated this time around.

The gauge has lost about 20% this quarter, versus a loss of less than 5% for an index of global stocks.

To factor in a possible extension of the Covid Zero strategy, Goldman Sachs and Nomura Holdings Inc. slashed their 2023 growth forecasts for China to below 5% last week.

“If no positive news come out on that front, the market could be disappointed,” said Jian Shi Cortesi, investment director at GAM Investment Management. “We control the exposure to re-opening names to hedge that risk.”

Meanwhile, China amping up its rhetoric against Taiwan is another risk that can heighten market volatility.

Beijing has said it has the patience to someday bring Taiwan under its control, while US President Joe Biden has repeatedly vowed to defend the island in the case of an invasion, an event which could force American firms to reduce their presence in China.

While Wall Street firms view the odds of armed conflict in North Asia as low, they see tit-for-tat sanctions between the US and China that disrupt the flow of finance and trade as ever more likely.

Notwithstanding all the uncertainties, some market watchers remain sanguine that the leadership gathering could offer some impetus for stocks.

“While there is no certainty that the zero-Covid policy will be relaxed post the CCP Congress, we do expect to see a more forceful policy response to the housing crisis,” SocGen strategists including Frank Benzimra wrote in Friday note. “It is therefore not time to capitulate.”

READ: Peak Pessimism Setting in for Chinese Stocks Ahead of Congress

(Adds more context on Taiwan tensions in the 17th paragraph. An earlier version corrected SocGen’s spelling in the third paragraph.)

©2022 Bloomberg L.P.