May 25, 2022

China Truck Data Showing Lockdown’s Hit Disappears From Public

, Bloomberg News

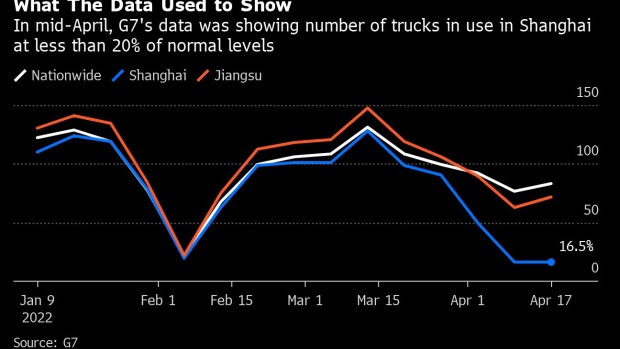

(Bloomberg) -- Real-time trucking data which shows the heavy toll of Covid restrictions on the Chinese economy is no longer being made publicly available, according to the company which collects the information.

G7 Connect has restricted who can see the data it gathers from millions of trucks across China, it said in a statement. Previously the data was available on its website and through other data providers, but the Beijing-based fleet management startup now requires pre-approved individuals and companies to log onto its website to access the information.

“This is intended for us to build better connections with individuals and institutions that care about road freight, and help them acquire more comprehensive and accurate insight,” G7 said in response to questions from Bloomberg News.

Especially in and around Shanghai, China’s Covid controls have blocked the easy flow of goods, with truck drivers caught in a web of quarantine controls. The loss of public access to G7’s data is making it difficult to assess the damage to freight traffic and the economy from those controls, and will make it harder for businesses to know whether the slow reopening of Shanghai is improving blocked supply chains.

Since the start of the outbreak in March, the trucking data had been widely used by investment banks such as Goldman Sachs Group Inc. to gauge the impact of lockdowns on China’s economy. The data had also been used by economists based at the Chinese University of Hong Kong and other universities to estimate the impact of lockdowns on gross domestic product, after they found truck flows and economic output were highly correlated.

Trucks carry about about three-quarters of China’s total freight, according to official data.

The road freight indexes compiled and published by G7 measured truck flows in each province, as well as at major logistics parks and key highways. The data was also recently removed from the database operated by Wind Information Co. at the request of G7, according to the Shanghai-headquartered provider of financial information.

Read more: Trucks in China Are Watching If Drivers Doze, Speed or Slack Off

Data after May 11 is no longer from the Wind service, according to a recent Goldman Sachs report. Wind did not say when the data stopped being available.

Even without the detailed data, the information the company has released shows that the situation is not back to normal for truckers and supply chains. National truck flows plummeted by 27% in April from the same period last year, G7 said in an article published on WeChat earlier this month. In the week through May 15 the road freight index was down 18% from a year earlier, a company executive told local media on Tuesday.

“About 80% of freight operators have not recovered to the level of freight volume before the epidemic,” marketing director Guo Yayun said in an interview. “The business volume of more than 50% of freight operators hasn’t even reached 30% of last year’s level. This has a huge impact on them and a very severe impact on society and the whole supply chain.”

Missing Data

This isn’t the first time that Chinese economic and financial data has suddenly become unavailable after gathering a lot of attention.

This situation is reminiscent of 2020, when data showing how much coal was burned each day to generate electricity stopped being released. Until it was no longer publicly available, that data was closely watched as a gauge for China’s recovery from the first lockdown after the outbreak of Covid-19.

And just this month, the main bond trading platform stopped releasing separate data on transactions by foreigners after the data showed big outflows from China’s financial markets.

G7 is backed by Chinese internet Tencent Holdings Ltd and was weighing an initial public offering in Hong Kong that could raise about $500 million as soon as this year, Bloomberg reported last month, citing people with knowledge of the matter said. Bloomberg LP, the parent of Bloomberg News, competes with Wind in providing financial analytics and information.

©2022 Bloomberg L.P.