Jun 25, 2021

China-U.S. Rivalry Brings Promise of Innovation Investors Crave

, Bloomberg News

(Bloomberg) -- U.S. President Joe Biden’s rallying call to the richest nations to counter China’s growing global influence may end up drawing investors to the markets of America’s rival.

This month’s Group of Seven and NATO meetings in Europe saw the U.S. marshal support for increased investment to compete with China. America also urged firmer condemnation of alleged human rights abuses, in a precursor to this week’s ban on some solar products made in the Xinjiang region.

As the communiques circulated, China was busy dispatching three astronauts to help construct its space station, and tapping additional resources in a sharper push for domestic innovation.

This turbo-charged race for dominance is morphing into another incentive to gain exposure to Chinese assets, which have already made significant inroads into global portfolios. A strategic rivalry will drive funding for technological development, with broader knock-on benefits for the economy, the argument goes. China’s semiconductor stocks illustrated the case last week, surging after President Xi Jinping appointed his economic czar to reinvigorate the chip sector in a bid to overcome U.S. sanctions.

“From an investor perspective, competition is always good,” Tuan Huynh, chief investment officer for Europe and Asia at Deutsche Bank International Private Bank, said in a phone interview. “Both sides want to invest as much as they can in tech and at this moment it’s too early to call a global leader, but it’s a major topic of the next five- to 10 years.”

The contest heralds the prospect of new national champions emerging in China. Huynh said he favors equities in the clean energy, consumer electronics and entertainment sectors, and that investors should increase their China exposure over time alongside their existing U.S. holdings.

Citigroup economist Li-Gang Liu sees a possible “Sputnik moment” for Chinese innovation, with the country’s goal of increased self-reliance triggering an era of rapid technological progress similar to the U.S.-Soviet rivalry that spurred the 1950s Space Race. Progress is already apparent, as just last month China’s Zhurong rover joined the U.S.’s Perseverance on Mars.

‘High Confidence’

While a technology arms-race is likely to boost U.S. assets as well as those in China, it’s the latter that is capturing the attention of international investment firms.

The world’s largest asset manager, BlackRock Inc., sees Chinese equities as a core strategic holding distinct from other emerging-market positions, according to a report this month.

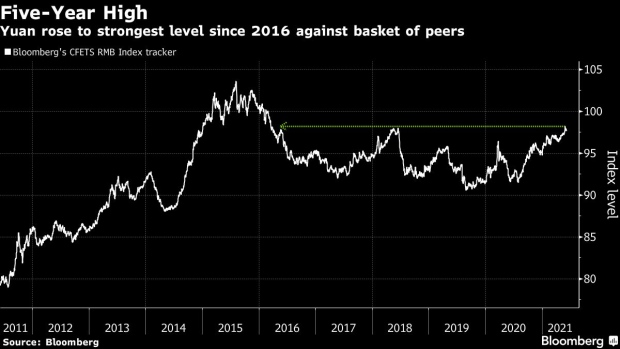

Pacific Investment Management Company LLC was among the money manager heavyweights extolling Chinese bonds for their their higher yields and resilience in this year’s global rates selloff. The yuan, meanwhile, has surged to the strongest levels since 2016 against trading-partner currencies amid China’s recovery from the pandemic.

“I’m looking at Chinese assets with high confidence,” said Deutsche Bank’s Huynh. But there are risks in some key sectors “more linked to national interests,” including telecommunications, he added.

Citi favors companies such as BYD Co. in the auto sector, and Tencent Holdings Ltd. and Alibaba Group Holding Ltd. among the internet giants. It also sees multiple sectors benefiting from China’s drive for innovation, such as semiconductors.

Nevertheless, while the tweet storms and tariff spats that characterized the prior U.S. administration’s engagements with China are gone, the substance of the tension is unchanged. Biden is continuing, with some adjustments, a Trump-era ban on U.S. investment in Chinese firms, which affects the three biggest in the latter’s telecommunications sector.

U.S. regulators last week stepped up pressure on tech suppliers they consider potential security risks, with a proposal to ban products from Huawei Technologies Co. and four other Chinese electronics companies.

Risks Remain

“Biden is locked into a clash with China and the result will be unhappy for investors who bet on deeper U.S.-China engagement,” said Matt Gertken, geopolitical strategist with BCA Research, who sees U.S. stocks as expensive and Chinese equities facing persistent headwinds from domestic and international politics.

Beijing’s regulatory crackdown on technology giants is among the recent obstacles, as the government tries to exert more control and temper financial risks without stifling innovation. That’s weighed on their equity-market performance this year even as the tech-heavy Nasdaq 100 Index in the U.S. continued to set new highs.

Overall, the shift in the tone and conduct of the U.S.-China confrontation may augur more orderly diplomatic ties and an improved long-term backdrop for investors seeking to exploit intensifying strategic competition. The two sides are slowly resuming official contacts, in contrast with the febrile atmosphere under Trump.

“The absence of the shrill rhetoric between the two countries -- a hallmark under the Trump administration -- is a welcome change for markets and should reduce the geopolitical risk premia for the time being,” said David Chao, global market strategist for Asia Pacific ex-Japan at Invesco.

©2021 Bloomberg L.P.