Jun 1, 2022

China Watchers See Investors Tracking Xi in New Low-Growth Era

, Bloomberg News

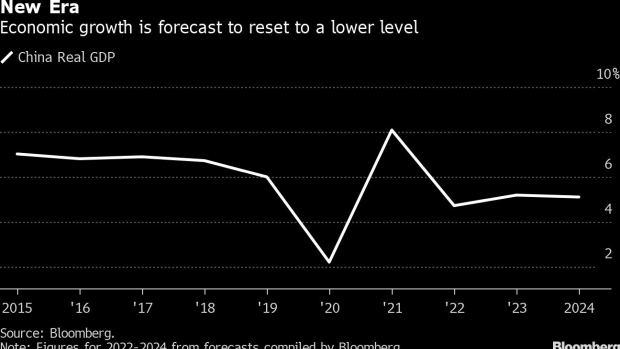

(Bloomberg) -- Hopes for a return to tried-and-true strategies for making money in China have given way to the realization that a new era of slow growth has arrived.

Investors are still chasing opportunities, despite two years of turmoil from President Xi Jinping’s crackdown on private enterprise and Covid Zero campaign. But they’re unlikely to find easy gains when the world’s second-largest economy finally gets clear of this year’s lockdowns.

Longtime China watchers warn that sub-5% expansion or even lower may be the new norm, and corporate profits will rise at a more moderate pace than previous years.

But investors who align with the Communist Party’s priorities -- in areas like green energy, infrastructure and others -- should prosper, they say. While multinational companies may relocate some operations out of China to diversify their supply chains, the country’s sprawling domestic market and swelling middle class means they’re unlikely to leave en masse.

Below is a selection of insights from China watchers on the outlook for the nation’s economy and markets.

Charlene Chu, senior analyst at Autonomous Research, a division of Sanford C. Bernstein & Co. Chu was previously a China analyst for Fitch Ratings, where she made a name for herself with warnings over debt risks in the shadow banking sector.

“Where I think China will lose out the most is on new capex by foreign multinationals, which I expect to be channeled predominantly to other countries. While I do expect some shift of existing operations out of China, I think the vast majority of China-based foreign operations will stay put, given the large domestic market and the fact that in many ways China still offers an unrivaled manufacturing platform.”

“The most important determinant of investment opportunities in China over the medium term will be how politics and regulation evolve. Both have become much harder to read as policy makers turn inward.”

Chin Ping Chia, head of China A investments, business strategy and development at Invesco Ltd. He previously ran MSCI Inc.’s Asia equity research business, playing an instrumental role in bringing yuan-denominated shares into MSCI’s benchmarks.

“The way to think about China is from a mid-to-long term perspective. And when you do, you see that opportunities are abundant. Everything in China seems to be selling at a discount. The order of importance for us is to make sure the things we invest in are aligned with the policy direction. China going green is a huge story. Big consumer names are all trading really cheap. China healthcare is a national priority and Covid really highlighted that.”

“There will be areas of national security interest where we could see friendshoring, sure. But unraveling decades of globalization takes time, and I don’t see it happening on a massive scale. This is not the time for companies to increase their costs, that’s a tall order. Companies will also want to reach their consumers easily, and for plenty of them that means staying in China.”

Victor Shih, an associate professor at the University of California San Diego, who researches elite Chinese politics.

“After the intense regulatory actions on tech companies in the past two years, it will take quite some time for the government to rebuild its credibility. The problem is that many of the regulatory actions, such as limitation on gaming, a ban on online tutoring, and regulations on data security and privacy, likely will not be reversed. Some regulations on pricing might be relaxed, which would be bullish. The problem is investors still do not know when the next “storm” will emerge.”

“Given the high impact of government policies on production and shipping, I suspect some foreign companies will seek production elsewhere where policy uncertainties are a bit less. I still do not expect a massive exodus from China since producing in China still comes with many advantages.”

Michael Pettis, a finance professor at Peking University, and author of books on global growth and restructuring in China.

“Over the next two to four years, as China struggles toward adjustment, growth rates may remain in the 3%-5% range. After that they are likely to be much lower.”

“There will always be good investment opportunities in China. China is a huge economy in which different regions and different sectors will perform very differently, and in which economic adjustment means a shift from the old drivers of growth to new drivers.”

“The real problem China poses to globalization is in the way it externalizes its very weak domestic demand. This is going to take many years to resolve.”

Stephen Roach, senior fellow at Yale University and author of the upcoming book on US-China relations “Accidental Conflict: America, China and the Clash of False Narratives.”

“Under Xi Jinping, the approach has shifted away from the analytics of consumer-led, services-led rebalancing to more of a idealogical approach that’s wrapped around the strength of his personality. That’s a very different development philosophy than the one that’s been so successful in delivering 40 years of spectacular growth in the Chinese economy.”

“There’s a number of specific headwinds -- whether they’re demographic, deleveraging, property, the regulatory pressures on private sector internet platform companies, common prosperity, the productivity issue -- that make this new approach far more problematic than anything that led me to conclude that China was unstoppable in the past. So yeah, I am worried. It will be a miracle if China hits 4% growth this year.”

Diana Choyleva, chief economist at Enodo Economics, a London-based research firm focusing on China.

“Even if successful, the structural transformation Beijing is attempting would take a while to bear fruit and the external environment is only set to deteriorate. On a two-to-three-year horizon, Chinese real GDP growth would do well to average 2%.”

“The world is bifurcating into two spheres of influence -- a Chinese and an America one --and it is inconceivable that financial and capital markets won’t follow suit. If you are an investor based in America’s sphere of influence, you must really ask yourself if you will be able to get your money out when the going gets tough. It’s a difficult choice as China has finally thrown the doors of its financial sector open to foreign investors and its huge markets offer good diversification.”

Jim O’Neill, the former Goldman Sachs Group Inc. chief economist who coined the term BRIC.

“I worry China is now creating more risks, rather than minimizing them. I had assumed growth this decade would be in the 4%-5% range. This could still be achieved, but the start of the decade is not very helpful obviously!”

“I am not necessarily bullish or bearish. I suspect given the dismal performance of recent years, there will be better years ahead for Chinese financial markets, but at the same time, unless they can deal better with the risks, then there is a danger of sustained financial market challenges, including for the yuan.”

Xu Gao, chief economist at Bank of China International in Beijing. He previously worked at the World Bank and the International Monetary Fund.

“China will not decouple from the world economy. Trying to reverse globalization completely goes against the laws of economics.”

“China’s economic structure will be adjusted, but infrastructure and real estate will play an important role in the Chinese economy in the long term. The change in policy attitude has been reflected in this year’s proposal by senior officials to moderately advance infrastructure investment and to comprehensively strengthen infrastructure construction and support rigid and improved housing demand.”

“A growth rate of 5%-6% in the next five to 10 years can be achieved.”

Ming Ming, chief economist at Citic Securities. He was previously an official at the People’s Bank of China.

“Real estate is still a very important variable. It may be the main driving force for China’s economy to rebound from the bottom in the next two to three years.”

“I am optimistic about high-end manufacturing. China has the advantage of the whole industrial chain, and our technological advantage in high-end manufacturing is quite obvious. Southeast Asia does have an influence on basic products and light industry, but the mid-end manufacturing industry, including the machinery and equipment used to produce light industrial products, are all imported from China.”

“There is not much risk in the Chinese government bond market. The government bond market is very stable and the global use of the yuan is increasing. In the future, more attention may be paid to China’s high-yield bond market and more private enterprises may enter the bond market.”

©2022 Bloomberg L.P.