Aug 18, 2022

Chinese Chip Software Maker Behind Mystery Buyer That UK Blocked

, Bloomberg News

(Bloomberg) -- A two-year-old Shanghai-based developer of chip design software was behind an attempt to buy a British firm that regulators blocked with little explanation, the latest example of Britain’s increasing hostility toward Chinese investment.

Super Orange HK Holding Ltd. was blocked from buying Bristol-based chip design software provider Pulsic Ltd., the British Business Secretary announced in a brief statement Wednesday. But that firm is in reality controlled by little-known Shanghai UniVista Industrial Software Group, according to Hong Kong public filings and Chinese corporate data. The Shanghai firm is backed by the National Integrated Circuit Industry Investment Fund -- the powerful $50 billion state-backed vehicle known within the industry as the “Big Fund.”

It’s unclear what roles Super Orange’s controlling shareholders played in the takeover attempt. Pulsic’s would-be acquirer was founded in Hong Kong in August last year by Nanjing Puxin Software, according to local filings. That firm is in turn wholly owned by UniVista, according to Chinese corporate database Tianyancha.

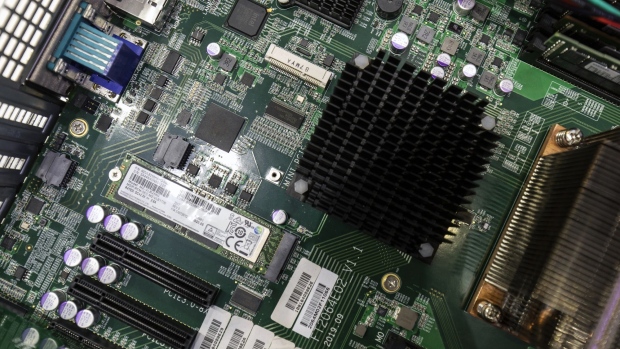

UniVista was incorporated only in 2020 and describes itself as a provider of Electronic Design Automation tools to the chip industry, or software kits vital to the design of semiconductors. Its No. 2 owner was the Big Fund, which typically bankrolls promising startups in their initial stages, according to Tianyancha.

Little is known about Puxin, the UniVista subsidiary that directly controls Super Orange. The office number listed in Puxin’s legal documents didn’t exist when Bloomberg News visited the Nanjing campus listed on Thursday. Several employees at the business park said the address didn’t conform with the usual format within the location.

Read more: Secretive Chinese Committee Draws Up List to Replace U.S. Tech

Representatives for Puxin and UniVista couldn’t be reached for comment. UniVista didn’t respond to an emailed inquiry sent to its registered email account, while phone calls to its offices went unanswered.

The US has been leaning on allies from the UK to Japan to join in efforts to block China’s chip goals. Pulsic is also a player in EDA tools, employed by leading chipmakers from Taiwan Semiconductor Manufacturing Co. to Intel Corp. Beijing considers the sector, dominated by American firms Synopsys Inc. and Cadence Design Systems Inc., a key bottleneck in its ambitions to build a world-class semiconductor industry and wean China off US technology.

Pulsic’s would-be acquirer -- Super Orange HK Holding -- had a sole and founding director identified as Zhou Nuo. In December, he ceded his post to Xu Yun, Hong Kong filings showed. Xu, the former head of Cadence’s Chinese business, is now a co-CEO at UniVista.

Xu, once named one of China’s most influential female chip executives, was also a director of the very similarly named Super Orange HK Ltd., a separate entity founded in March that’s in turn wholly owned by Shanghai UniVista Technology. Her co-CEO is Pan Jianyue, who headed Synopsys Inc.’s China and Asia-Pacific business before the pair founded the other UniVista Industrial in 2021.

Read more: UK Blocks Takeover of Design Firm Amid Chinese Security Fears

Xu and Pan harbor ambitions to not just replace American technology but build a globe-spanning operation that can go toe-to-toe with the industry’s leaders, according to an interview they gave The Paper in November.

The parent entity of Puxin -- Super Orange HK Holding’s sole owner -- used a UniVista email address as its registered contact information in Tianyancha.

Stopping the Super Orange acquisition is a continuation of a recent trend.

The British government worked to end China General Nuclear Power Corp.’s involvement in UK projects and Boris Johnson’s administration also blocked Huawei Technologies Co. from participating in Britain’s 5G network.

And there are similar decisions in the pipeline. Britain is probing a Chinese-led takeover of Newport Wafer Fab, which owns the UK’s largest semiconductor plant, with a decision due in September. MPs are also calling for a ban on the sale of closed-circuit television cameras from the Chinese firms Hangzhou Hikvision Digital Technology Co. and Zhejiang Dahua Technology Co.

China’s Vast Blueprint for Tech Supremacy Over U.S.: QuickTake

(Updates with details of UniVista’s aspirations from the 10th paragraph)

©2022 Bloomberg L.P.