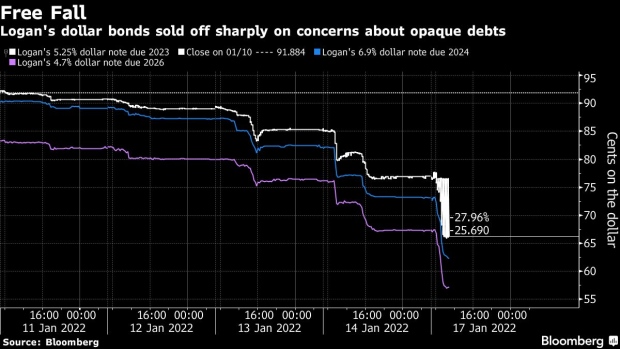

(Bloomberg) -- Logan Group Co.’s bonds tumbled to record lows amid speculation the Chinese property firm may have far more debt obligations than reported.

Logan’s dollar note due 2023 sank 10.8 cents to 66.1 cents as of 10:50 a.m. in Hong Kong, leading declines among Chinese developers. Its shares fell 3.2%. Other junk rated property bonds fell about 3 cents on the dollar Monday morning, according to credit traders.

The developer, which is China’s 20th-largest by contracted sales, on Friday denied rumors that it had privately placed debt after concerns over its obligations prompted a broad selloff across its dollar notes. Logan also denied a Debtwire report published later that day that claimed the firm provided guarantees on two loans and two credit-enhanced notes. The report stated Logan could be on the hook for $812 million of guarantees on outstanding obligations due through 2023.

Logan holds the equivalent of a double B rating from all three major credit risk assessors and some of its notes traded at par just last month. The company and its subsidiaries have some $1.3 billion of local and offshore notes coming due this year, Bloomberg-compiled data show, including a 2 billion yuan ($314.6 million) due Feb. 1.

©2022 Bloomberg L.P.