Mar 1, 2022

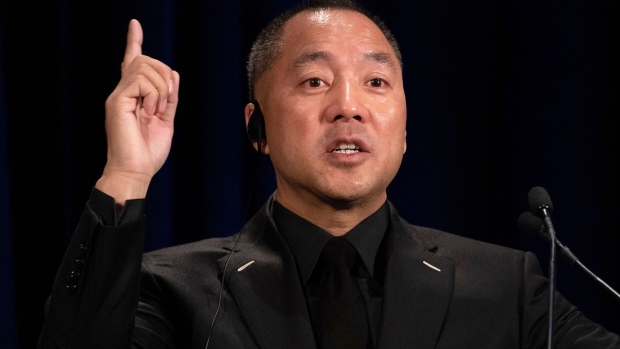

Chinese Exile’s Legal Foe Calls Bankruptcy Filing ‘Astonishing’

, Bloomberg News

(Bloomberg) -- The insolvency case of Guo Wengui, the exiled Chinese businessman, got off to raucous start Tuesday when a longstanding creditor called the move “astonishing” and signaled it would wage an aggressive fight in bankruptcy court.

Guo, a former partner of Trump political strategist Steve Bannon, filed for bankruptcy last month after moving a yacht from New York waters, a shift that would keep it out of the reach of creditors, and then facing a $134 million penalty for taking that step. Guo’s biggest creditor is Pacific Alliance Asia Opportunity Fund, which made a loan of $30 million to the businessman in 2008.

That loan has since ballooned to more than $116 million with accrued interest. In papers accompanying his bankruptcy filing, Guo said he had almost no assets and little income. But the businessman has often been seen aboard the yacht at issue, a vessel purchased for about $30 million known as Lady May. A New York judge found last month that Guo owns or controls the yacht, an asset that was not disclosed in his bankruptcy filing.

“The lack of candor to this court already is what impels us to believe that no quarter should be given,” Peter Friedman, an attorney for Pacific Alliance Asia Opportunity Fund, said at Guo’s first bankruptcy hearing in Connecticut. Friedman said Guo has “a maze of entities, and family members, and trusted confidants to shift around assets” for him and said he can’t be trusted.

An attorney for Guo, Bennett Silverberg of law firm Brown Rudnick, said his legal team had very little time to assemble the bankruptcy filing papers. Guo does not read or write in English, Silverberg said, and the lawyer requested as much as 60 additional days to translate documents and disclose Guo’s assets and liabilities.

Silverberg also said that Pacific Alliance Asia Opportunity Fund may ultimately benefit from the bankruptcy, as creditors will have the opportunity to investigate Guo’s finances.

“If the allegations are true, and we say they are not, then the bankruptcy case may be the best thing that could’ve happened to them,” Silverberg said.

U.S. Bankruptcy Judge Julie Manning gave Guo until March 9 to finish his financial disclosures, far less than the 60 days requested.

The bankruptcy case is Ho Wan Kwok, 22-50073, U.S. Bankruptcy Court for the District of Connecticut (Bridgeport).

©2022 Bloomberg L.P.