Oct 14, 2019

Chinese Fertilizer Maker on the Brink of Bankruptcy Rallies 44%

, Bloomberg News

(Bloomberg) -- An insolvency case in a remote city on the Tibetan Plateau shows how in China, most outcomes are better than getting booted out of the stock market.

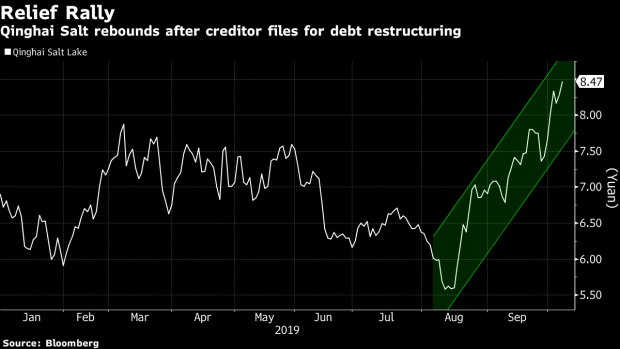

A local court in Qinghai -- a huge and sparsely-populated province that’s home to the country’s largest lake -- threw a lifeline to Qinghai Salt Lake Industry Co. when it accepted a creditor’s request to restructure the firm. Stock investors took it as a sign the struggling state-owned potash producer will survive: the shares are up 44% since the petition was filed in August.

It’s an example of how even a potentially dilutive deal -- like a debt-to-equity swap -- would be positively received by shareholders. Shenzhen-listed Qinghai Salt Lake is still a serious candidate for delisting after reporting net losses for two straight years, and the terms of its restructuring have yet to be announced.

“Stock traders are encouraged by the company’s progress on resolving its debt problems,” said Jiang Liangqing, a money manager at Ruisen Capital Management in Beijing. “They expect the restructuring to give it some breathing space and to reduce its debt burden.”

Calls to Qinghai Salt’s media department seeking comment on the restructuring went unanswered (Qinghai Salt Lake hasn’t yet provided details of its plans -- and there’s still the risk it could go bankrupt). Ruisen Capital’s Jiang says the company may be able to cut its debt load, delay payment or swap some of its debt into equities.

Defaults in China’s onshore bond market remain high in 2019, after a record year in 2018. Companies defaulted on almost 100 billion yuan ($14 billion) of domestic bonds as of Oct. 14, following 120 billion yuan of defaults in 2018, according to data compiled by Bloomberg.

Qinghai Salt has defaulted on three outstanding bonds amounting to about 6.2 billion yuan. It had assets of 73 billion yuan and total liabilities of 55 billion yuan as of the end of June, according to its half-year report. It posted a net loss of 424 million yuan for the period, after a 3.5 billion yuan loss in 2018.

The start of restructuring proceedings at least offers Qinghai an opportunity to reduce its debt, removing a key overhang for a stock that has lost more than 85% since a 2008 peak. Its debt-to-equity ratio exceeds 200%, the highest since at least 1994, according to data compiled by Bloomberg.

“Investors are glad to see distressed companies finding a way out,” said Jiang. “It’s an encouraging sign.”

To contact Bloomberg News staff for this story: Ken Wang in Beijing at ywang1690@bloomberg.net;Yuling Yang in Beijing at yyang329@bloomberg.net

To contact the editors responsible for this story: Sofia Horta e Costa at shortaecosta@bloomberg.net, David Watkins

©2019 Bloomberg L.P.