Dec 5, 2022

Chinese Stocks in US Resume Rally as Beijing Hastens Covid Pivot

, Bloomberg News

(Bloomberg) -- The rally in US-listed Chinese stocks continued on Monday as easing Covid curbs in major Chinese cities fueled optimism that Beijing is hastening the shift away from its Covid Zero strategy.

The Nasdaq Golden Dragon China Index of 65 US-listed Chinese stocks climbed 1.6%, adding to a gain of 22% last week. Internet giants Alibaba Group Holding Ltd. and JD.com Inc. rose 1% each.

Stocks that stand to benefit strongly from reopening, such as online travel agency Trip.com Group Ltd. and Yum China Holdings Inc., also gained. The rally in stocks also came amid a surge in China’s offshore yuan, with the currency strengthening by more than 1% past the key 7-per-dollar level.

China’s major cities including Shanghai, Hangzhou and Shenzhen dropped mandatory Covid testing requirements to enter many public venues, even though substantial testing rules remain in place. These moves provide further evidence that authorities are softening their zero-tolerance stance toward Covid in the aftermath of nationwide protests.

“Investors are clearly very surprised by the Chinese authorities’ U-turn relaxation of dynamic Covid zero rules coming into the winter flu season and without a domestic mRNA vaccine,” Jefferies strategists led by Sean Darby said in a note on Sunday. A deterioration in economic conditions means Beijing needs to “throw everything at the economy now,” they wrote.

With China turning a page on its Covid defense, investors are becoming increasingly bullish on the short-term outlook of the country’s equities. Fund manager Abrdn Plc said investors should go back into China stocks and singled out cheap valuations as a positive. Morgan Stanley strategists lifted China to overweight from an equal-weight position they had held since January 2021, while warning that the reopening path is set to be bumpy.

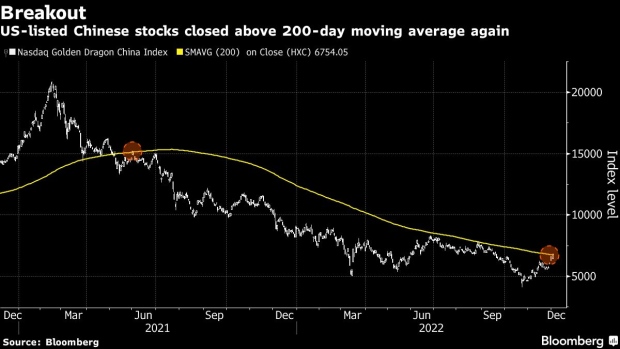

Technical factors might have also been aiding US-listed Chinese stocks. The Nasdaq Golden Dragon Index closed above its 200-day moving average on Friday for the first time since June 2021. A breakout from the key resistance level typically signals more potential gains.

But some warned that a pullback could be in store given how quickly Chinese stocks have rallied in recent sessions. With key gauges approaching technical overbought levels, the stocks may take a breather to digest recent gains, according to Matt Maley, chief market strategist at Miller Tabak+ Co. “We believe investors should avoid being too aggressive on these names,” he said in a note.

--With assistance from Yiqin Shen.

(Updates with share-price move at the open and adds commentary in the eighth paragraph.)

©2022 Bloomberg L.P.