Oct 28, 2021

Chip Crunch Hits Customers Like ‘Never’ Before Year Into Crisis

, Bloomberg News

(Bloomberg) -- When semiconductor shortages began to hit automakers and other customers late last year, executives voiced optimism that supplies would quickly return to normal. They’re still waiting.

As companies report earnings for the third quarter, it’s clear the crisis is far from over. Chip shortages -- and related supply-chain snarls -- are hammering financial results around the world and across industries.

Just this week, General Motors Co. reported a 25% drop in revenue and admitted shortages would crimp performance into next year. Maruti Suzuki India Ltd. forecast a hit to sales. Samsung Electronics Co. warned it couldn’t predict financial results for 2022 given all the uncertainties. The Japanese robotics giant Fanuc Corp. lowered its financial forecast for the year and said the current situation is unprecedented in its 50-year history.

“We have never experienced this kind of a shortage of semiconductors before,” said Chief Executive Officer Kenji Yamaguchi during a call with investors. “We are receiving a lot of orders but can’t increase production to meet them because we just can’t procure the necessary parts.”

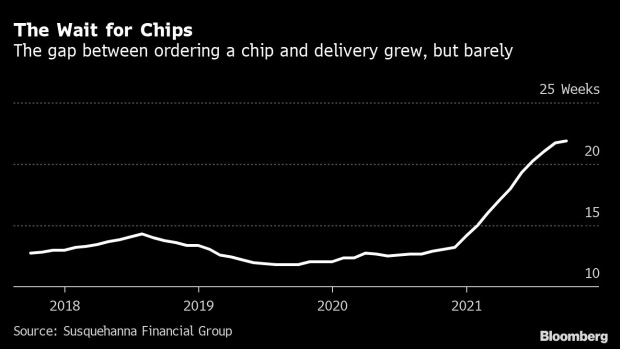

Such comments undercut suggestions the crisis is easing. The wait time for chips -- which had reached historic highs -- began to level off in October, for example.

But top executives made clear in comments this earnings season that the chip crisis remains of top concern. Here is an overview:

Automakers Get Hit

- “We are selling every vehicle we can make,” General Motors CEO Mary Barra said on Bloomberg TV. While she characterized the chip shortage as a “near-term problem,” Barra said it will linger into next year, and GM will be in a much better shape in the second half of 2022. GM shares shed more than 5% on Wednesday.

- Ford Motor Co. raised its profit forecast for the full year and its stock soared. But Chief Financial Officer John Lawler said the company’s factories won’t run at full tilt until the end of next year and the chip crisis could extend into 2023. “We seeing about 10%” sales growth in 2021, Lawler said. “And we see that the chip constraint will still hit us.”

- “We didn’t expect to lose so much production in the second quarter due to chips or that the commodity prices would shoot up,” said Maruti Suzuki Chairman R.C. Bhargava in an earnings call Wednesday. “What we had expected in terms of volumes and profitability has changed substantially.”

Chipmakers Crank Up Spending

- TSMC, the world’s most valuable chipmaker, has pledged to invest $100 billion in new capacity from 2021 to 2023, but CEO C.C. Wei said its capacity will be constrained for at least another year. “We expect TSMC’s capacity to remain very tight in 2021 and throughout 2022,” he said. “This is because of our technology leadership position.”

- Intel Corp. laid out an ambitious plan to invest in new foundry capacity, sending shares tumbling 12% as investors worried about profitability. “We could have chosen a more conservative route with modestly better financials,” CEO Pat Gelsinger said, “but instead the board, the management team, and this is why I came back to the company, choosing to invest to maximize the long-range business that we have.”

- Samsung plans to triple its foundry capacity by 2026 compared with 2017 in order to respond soaring demand. It argued the chip shortage was not an issue of an absolute shortage of output, but rather it was “mismatch” of supply and demand. “Even though it’s just difficult to say definitively, we are carefully hoping that perhaps the situation may start to somewhat ease from second half of next year,” said Jinman Han, executive vice president at Samsung, during an earnings call.

Economies Suffer

- The chip crunch is sweeping enough that it has hurt national economies. Germany this week cut its 2021 outlook to 2.6% growth the 3.5% estimate published at the end of April. “The lack of chips has meant that hundreds of thousands of cars cannot be finished and delivered,” Economy Minister Peter Altmaier said at a Berlin news conference. “So it’s important that we make sure that international supply chains are maintained and revived.”

Overcapacity Concern

- Chipmakers have pledged more than $700 billion over the next decade to expand their production capabilities, raising concerns that the industry will hurtle from chronic shortages into money-losing overcapacity. Governments from China to the U.S., Japan and South Korea have all encouraged additional investments in what they view as a strategic industry.

©2021 Bloomberg L.P.