Oct 21, 2020

Chipotle's Digital Dominance Is a Mixed Blessing

, Bloomberg News

(Bloomberg Opinion) -- The headline number from Chipotle Mexican Grill Inc.’s latest earnings report is, in some ways, a return to form. The burrito chain on Wednesday reported robust comparable sales growth of 8.3% from a year earlier, a result that is in the ballpark of what the company routinely recorded on this metric before the pandemic rocked the dining industry.

But don’t mistake that for things being back to normal at Chipotle or anywhere else in the wider restaurant world. Chipotle was able to notch those gains because it has transformed into a dramatically different business in recent months, one where digital ordering has gone from a promising growth area to a critical component of sales.

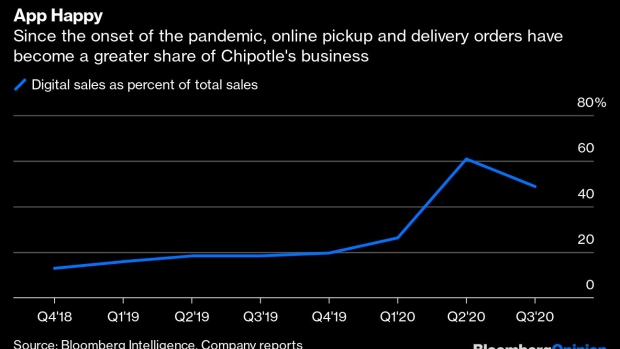

In the latest quarter, digital pickup and delivery orders comprised 48.8% of sales. That is up sharply from the 19.6% of sales it accounted for in the quarter before the pandemic began shaping results. (It is a lower proportion than was recorded in the quarter ended in June, but that’s to be expected, as local regulations have allowed more dining rooms to reopen.)

Chipotle had laid plenty of groundwork in recent years to handle an influx of online ordering. It added dedicated pickup shelves to its restaurants for easy order retrieval. It increased its ability to fill these orders by installing second “make lines” that are equipped with technology to help workers assemble burritos more quickly and accurately. And it has invested in free delivery promotions to get people to give online offerings a try.

That work appears to have helped Chipotle easily outperform the broader restaurant industry in recent months. Comparable sales for the fast-casual category hadn’t recovered from the pandemic slump as of September, according to MillerPulse data. The restaurant industry overall had only modestly positive comparable sales that month after suffering declines in each preceding month since March.

Chipotle’s digital dependence probably won’t stay this high over the long haul. Plenty of its dining rooms remain open at only partial capacity, and many consumers are not comfortable with indoor dining at this point in the public health crisis. But as those things change, so will Chipotle’s sales mix.

That may be for the best, given that the rise of delivery has brought profitability challenges. Chipotle’s operating margin shrank to 19.5% from 20.8% in the year ago period, dragged down by expenses associated with delivery. Chipotle is testing menu price increases of about 7% for delivery orders to offset some of that pressure. The fact that the chain is experimenting with such a step underscores its unique positioning in the industry; fast-food competitors would have an extremely hard time implementing something similar.

The profit pressure should not completely obscure some of the less-obvious benefits for the burrito chain that have come out of the widespread adoption of online ordering. For one, many customers have tried Chipotle for dining occasions such as dinner or group meals that they wouldn’t have otherwise, behavior that might stick beyond the pandemic. Plus, Chipotle executives have said they can better control food costs when online is a higher proportion of sales. A persuasive diner at the in-person ordering counter might get an extra heap of cheese or beans for no charge. With pickup and delivery orders, the portion sizes are more consistent. That likely helped keep food, beverage and packaging costs to 32.3% of revenue, down nearly a full percentage point from a year earlier.

Whatever the near-term profit challenges, Chipotle has done the right thing by leaning hard into digital ordering. Diners won’t stay at home forever, and Chipotle will have an easier time luring them back to the dining room after having served them burritos at their doorsteps for all these months.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Sarah Halzack is a Bloomberg Opinion columnist covering the consumer and retail industries. She was previously a national retail reporter for the Washington Post.

©2020 Bloomberg L.P.