Jul 4, 2022

Church of England Foundation Will Sell Bonds for the First Time

, Bloomberg News

(Bloomberg) --

The Church of England’s main foundation is raising money in the debt market for the first time.

While it’s highly unusual for a religious organization to sell bonds, the Church of England has a track record of active investment, especially in socially responsible causes.

The Church Commissioners for England, which manages a £10 billion ($12.1 billion) investment portfolio on behalf of the church, will sell the pound-denominated debt.

Proceeds being used for general purposes, as well as environmental and social projects, according to a person familiar with the matter, who asked not to be identified because they’re not authorized to discuss the matter. Representatives of the church will start speaking to investors on Monday to gauge market interest.

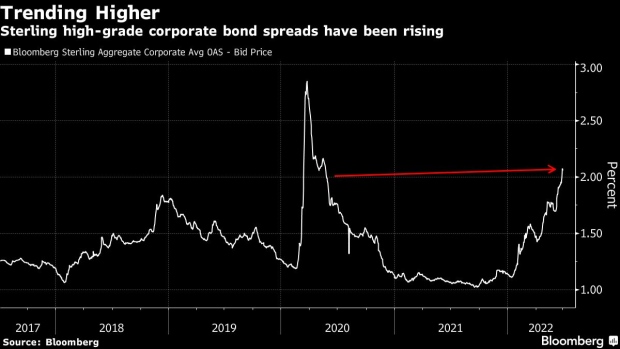

The bond sale is also unusual because it’s coming at a time when other organizations are scrapping their debt sales due to market volatility. Corporate pound-bond sales this year are running at about half the pace of 2021, according to data compiled by Bloomberg.

While investors will undoubtedly regard the church as a safe issuer, borrowing costs have risen substantially in the past few months. In the UK, an index tracking sterling-bond spreads is near the highest since 2020.

Recession Unease Sends Pound Crashing to Worst Quarter Since ‘08

Other investment arms of the church have sold bonds in the past. The Church of England Pensions Board has two bonds that total £150 million.

Proceeds of the sustainable bond will be used to finance green and social projects, such as renewable energy, clean transportation, green buildings and climate change adaptation, according to the church’s sustainable finance framework.

Bank of America Corp., JPMorgan Chase & Co. and Morgan Stanley are arranging the virtual investor meetings, said the person familiar with the deal. The church didn’t immediately reply to a Bloomberg News request for comment.

©2022 Bloomberg L.P.