Aug 19, 2022

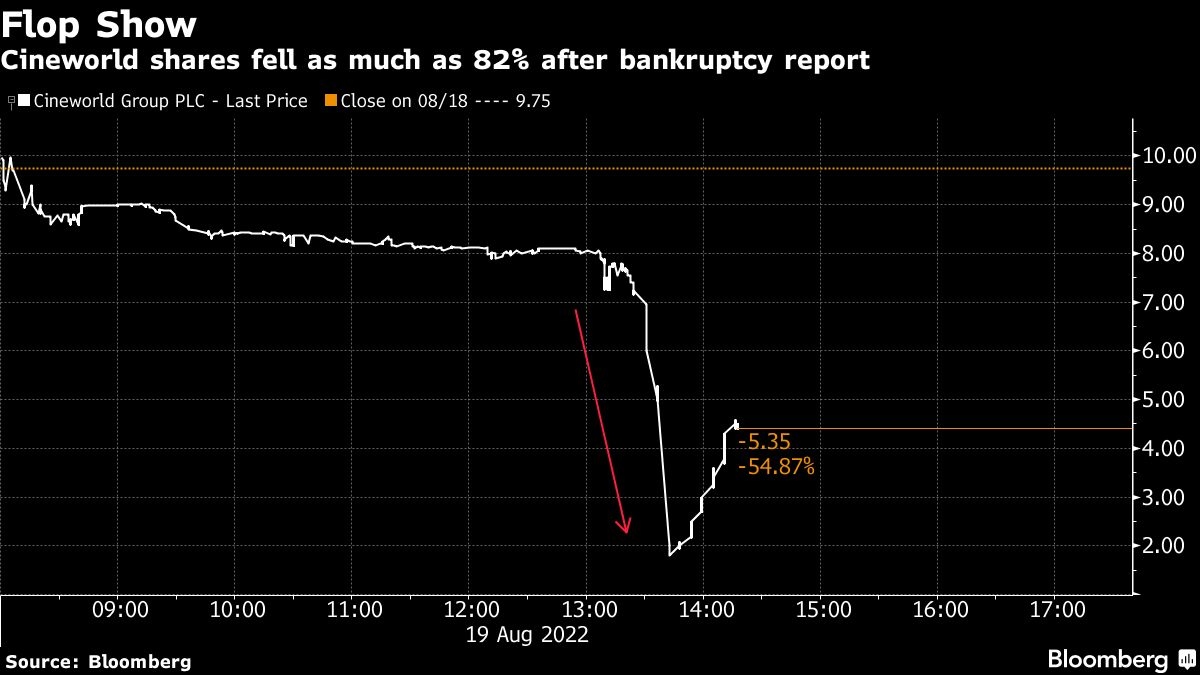

Cineworld tumbles 82% after report on U.S. bankruptcy plan

, Bloomberg News

Cineworld appealed Ontario court ruling after failed tie-up with Cineplex

Cineworld Group Plc shares slumped more than 80 per cent after the Wall Street Journal reported that the world’s second-largest cinema operator is planning to file for bankruptcy in the US within weeks, citing people familiar with the matter.

The report said Cineworld has engaged lawyers from Kirkland & Ellis LLP and consultants from AlixPartners to advise on the Chapter 11 filing. It is also considering filing an insolvency proceeding in the UK, the Journal added.

A company spokesperson referred to Cineworld’s statement earlier this week when contacted for comment.

Cineworld said Wednesday that it was considering a restructuring to ease its debt burden. The cinema chain racked up large debts from acquisitions, and has suffered from a weak box-office recovery following COVID-19 lockdowns that kept customers away from theaters.

Cineworld fell 59 per cent to 4 pence at 2:20 p.m. in London trading on Friday after earlier dropping as much as 82 per cent.

Cineworld shares fell as much as 82 per cent after bankruptcy report

The company is “in active discussions with various stakeholders and is evaluating various strategic options to both obtain additional liquidity and potentially restructure its balance sheet,” the company said in an update Wednesday.

“Any de-leveraging transaction will likely result in very significant dilution of existing equity interests in Cineworld,” it said.