Aug 4, 2021

Citi Cuts Tech-Heavy U.S. Stocks on Treasury Yield Surge Call

, Bloomberg News

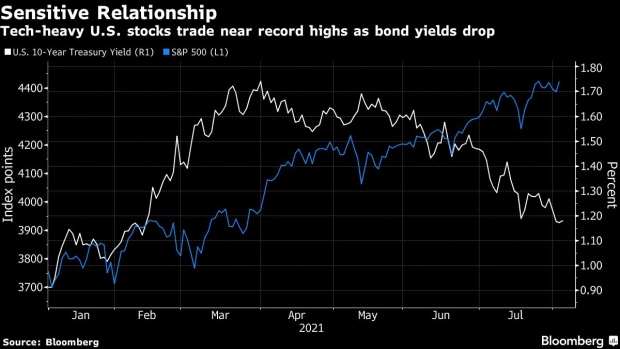

(Bloomberg) -- U.S. stock market returns may suffer as economic recovery and possible monetary tightening are set to fuel a surge in Treasury yields, according to Citigroup Inc. strategists.

Citi downgraded U.S. stocks to neutral from overweight on Wednesday due to the large prevalence of tech companies, which are vulnerable to higher rates. The recent rally in government bonds will be temporary before macro growth fuels a rise in 10-year yields to 2% into 2022, according to Robert Buckland and his colleagues.

READ: Bonds Feel Pull of Sub-Zero Yields as Virus Concern Takes Toll

Bonds have been rebounding in recent months, pushing the 10-year yield down to 1.18% amid a resurgence in Covid-19 cases and concerns that the global recovery isn’t as strong as expected. With the S&P 500 trading at record highs, a possible resumption of the ascent in yields could make the stock market, and growth shares in particular, vulnerable to selloffs.

“The U.S. equity market is more vulnerable to higher real yields because it has a heavy growth stock weighting,” the Citi strategists said in a note.

At the same time, Citi says a jump in Treasury yields is unlikely to be “fatal” for global equities because of strong early-cycle earnings growth supporting risk sentiment. The strategists expect the two factors to cancel each other out over the next 12 months, predicting flat returns for the MSCI World Index by mid-2022.

Citi upgraded Japanese equities to overweight, citing cheap valuations and sensitivity to global cyclical recovery. It also kept U.K. stocks at overweight thanks to their positive correlation to higher bond yields. Among equity sectors, financials and materials will benefit from a rise in borrowing costs, the strategists say.

READ: Europe’s ‘Most Oversold’ Market Still Overlooked: Taking Stock

According to a Bloomberg survey of forecasters, the 10-year Treasury rate will rise to about 1.8% by the end of 2021. Bearish Citi strategists point to technical factors behind the recent drop in yields, such as the unwinding of short positions and supply dynamics, with the march toward 2% likely to resume soon.

©2021 Bloomberg L.P.