May 16, 2023

Citi's Clark says inflation cements her outlier call for June rate hike in Canada

, Bloomberg News

Canada's job market remains strong more than one year into the Bank of Canada's rate hiking cycle

The only economist in a Bloomberg survey who’s forecasting an interest-rate hike at the Bank of Canada’s next meeting is confident the latest inflation data prove she’s right.

Even before Tuesday’s unexpected acceleration in headline inflation, Citigroup Inc.’s Veronica Clark had been predicting the central bank would raise borrowing costs by 25 basis points on June 7. Tuesday’s consumer price figures have cemented her call — and she’s surprised other economists have yet to change their forecasts.

“The Bank of Canada is literally saying we’re waiting to see if we’ve done enough, and none of the data is telling you that you’ve done enough. I’m trusting what they say,” Clark said in a phone interview. “It’s been hard for markets to imagine another hike in Canada. But the Bank of Canada is first and foremost an inflation-targeting central bank, and inflation looks sticky, strong and much higher than 2 per cent.”

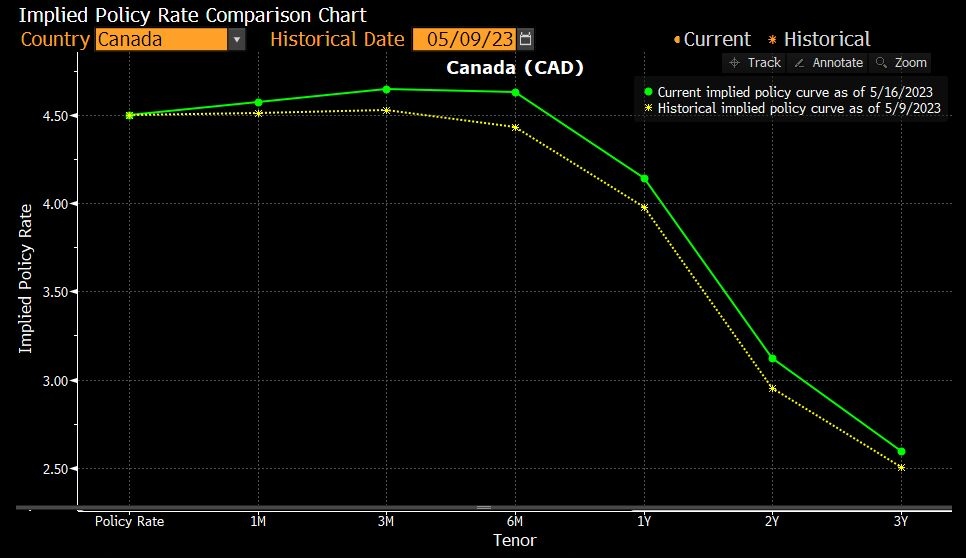

Rates markets reacted quickly to the unexpectedly hot inflation print. Swaps traders are now placing bigger bets on a hike in June or July and have reduced the odds of a rate cut in 2023 to zero. Just a week ago, traders were pricing in as many as two cuts over the next 12 months.

The Bank of Canada raised its benchmark overnight rate eight straight times to 4.5 per cent before signaling a conditional pause in January. While Clark is currently the only economist among 28 forecasters in the survey who expect a hike next month, others have started flagging rising chances that policymakers will soon be pulled off the sidelines.

“There is a highly compelling case for returning with a hike at the June meeting and if not then July’s odds go up,” Derek Holt, an economist with Bank of Nova Scotia, said in a report to investors. “I would assign high market probability to a June hike with info to this point.”

For Clark, the substantial upside surprise to April’s consumer price index signaled to markets that there’s a “distinct possibility” the bank needs to hike again after holding for two straight meetings. She also said surging home prices present a “clear risk” that inflation could accelerate further.

Since the Bank of Canada’s first move in this tightening cycle in March 2022, Clark was right nine out of 10 times. Her only miss was in July, when the bank surprised markets with a full percentage-point increase to borrowing costs versus her call for a 75 basis-point hike.