Mar 19, 2020

Citi Says Stock Prices Only See 30% Earnings Slide, More to Come

, Bloomberg News

(Bloomberg) -- Global equities are likely pricing in a 30% decline in corporate earnings per share, with selling likely to continue until new infections peak in the U.S., according to Citigroup Inc.

Stocks typically mirror declines in earnings during a global recession, falling an average of 38%, strategists including Robert Buckland wrote in a research note Wednesday. The speed of this year’s plunge is already much faster than past episodes and may not reverse until new infections peak, they said.

“Markets may already be discounting a 30% EPS drop, but not the 58% collapse seen in the financial crisis,” the note said. “It typically takes a year of EPS recession, and associated bear market, for equities to fall this much. It’s the same for the VIX and credit spreads.”

The S&P 500 has tumbled, briefly falling to its lowest levels in three years, as strategists cut target prices and investors struggle to take into account the effect of the coronavirus outbreak on economies across the world. The index is down 29% from its mid-February highs.

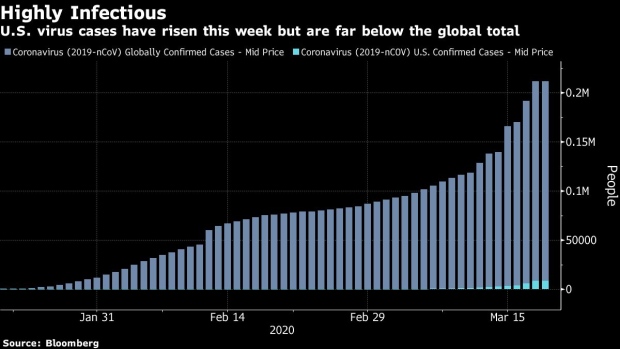

Despite the substantial declines, Citi’s analysts advised against buying the dip until indicators signaling a turn emerge. While in past recessions, improving macro data such as purchasing manager’s indexes sent a buy signal to global markets before earnings recovered, stabilization in coronavirus infection rates may be the catalyst this time, they said.

“If U.S. infections started to roll over, we suspect the equity market wouldn’t wait for improving PMIs,” the note said. “One of our favorite investor quotes in recent weeks is ‘this isn’t over until U.S. cases peak.’”

©2020 Bloomberg L.P.