Jun 25, 2020

Citi warns pandemic rallies in Netflix, Wayfair may falter

, Bloomberg News

Notable Calls: Tesla, Shopify and Netflix

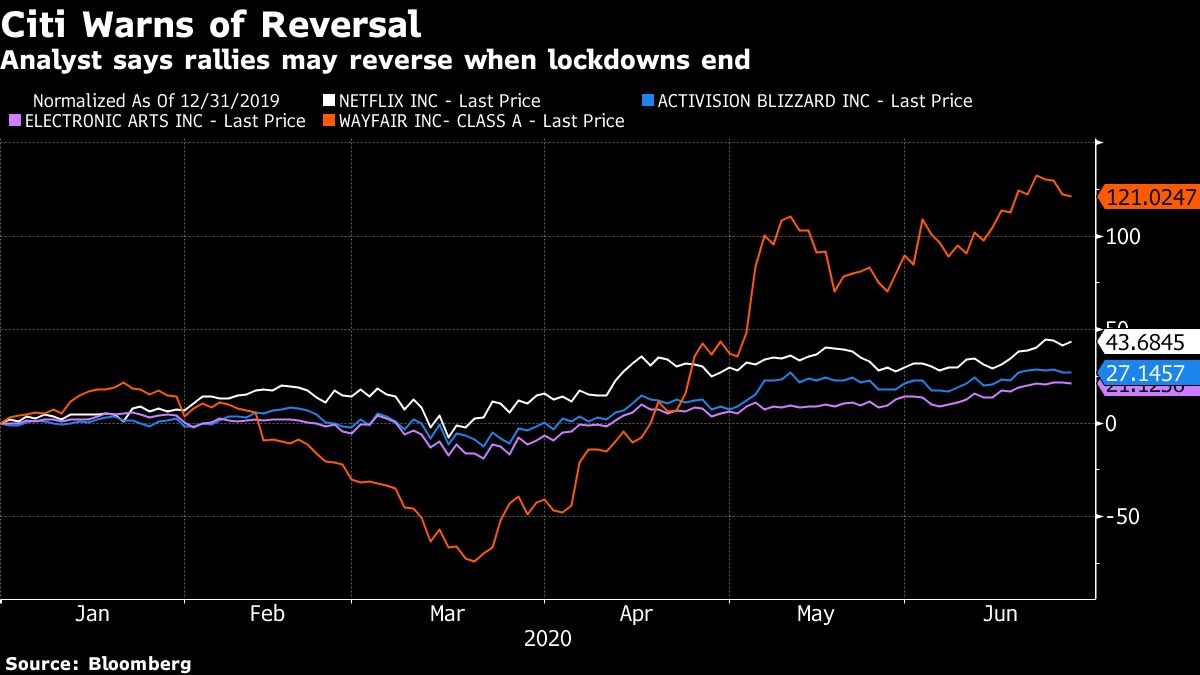

Stocks that have seen pronounced rallies as a result of the pandemic driving higher demand may see those gains soon reverse, according to Citi, which cited Netflix and Wayfair as potentially vulnerable names.

Companies that “benefitted from the shelter in place orders” are the group “that makes us most nervous,” the firm wrote. “When COVID-19 isn’t fully behind us, but consumers can leave their homes, we suspect results at firms like Netflix, Electronic Arts, Wayfair and Activision may falter.”

Citi noted that companies like Netflix have seen higher demand and engagement during the pandemic, although “it is not clear how permanent these trends will be,” and when pandemic lockdowns end, “we suspect results will revert to long-run averages.”

Both Electronic Arts and Activision have both gained more than 20 per cent in 2020, while Netflix is up more than 40 per cent and Wayfair has soared more than 120 per cent.

Analyst Jason Bazinet noted that in many such cases, stock prices have risen more than consensus estimates. This dynamic means the most important question has become, “Will COVID-19 cause a large enough secular shift in demand to justify the multiple expansion?”

Citi was more optimistic about other names that have see pandemic-related gains, singling out Amazon.com as a likely long-term winner. While near-term results “have certainly benefitted from COVID-19, we suspect there will be a more permanent shift towards e-commerce when the COVID-19 lock-down ends.”

This view has been widely echoed across Wall Street. Earlier, Wedbush wrote that there was “a perfect flywheel effect coming out of this pandemic,” with consumer behavior moving online. Analyst Ygal Arounian added that “coronavirus didn’t spark the flame, but it certainly fanned it.”