German Real Estate Firm Adler Reaches Agreement With Lenders

Troubled German real estate firm Adler Group SA has reached a non-binding agreement with bondholders, according to a company statement released on Thursday morning.

Latest Videos

The information you requested is not available at this time, please check back again soon.

Troubled German real estate firm Adler Group SA has reached a non-binding agreement with bondholders, according to a company statement released on Thursday morning.

The deep freeze that’s gripped Europe’s real estate markets since borrowing costs jumped worsened at the start of the year as deals plunged to their lowest levels since 2011.

Investors are looking for the next policy domino to fall in Asia amid an escalating campaign against a resurgent dollar, after Indonesia used a surprise interest rate hike to defend the rupiah.

Vietnamese billionaire Pham Nhat Vuong pledged to invest at least another $1 billion of his personal wealth into VinFast Auto Ltd., providing the capital needed for expansion of the struggling electric vehicle maker.

Macrotech Developers Ltd., a real estate firm that operates under the brand name Lodha, expects pre-sales to grow about 20% in the year to March after reporting its highest ever quarterly revenue.

Sep 22, 2019

, Bloomberg News

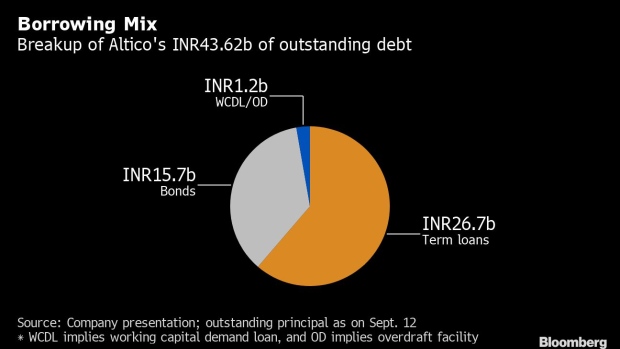

(Bloomberg) -- Beleaguered Altico Capital India Ltd. said a prolonged cash squeeze for India’s shadow lenders and property developers after the collapse of IL&FS Group last year led to its default.

Substantial strain in the short-term financing markets following a default by IL&FS caused a knock-on impact on other non-banking finance companies and the real-estate sector, Altico Capital said in a statement on Sunday. The financier is “facing challenges many similar businesses face in this environment,” it said.

Altico Capital, a non-banking finance company that focuses on lending to the real-estate sector, said earlier this month that it didn’t pay 199.7 million rupees ($2.8 million) of interest on borrowings from Dubai-based Mashreqbank PSC.Altico’s default worsens liquidity woes for the country’s shadow lenders, prolonging a cash crunch for the stressed sector. The squeeze has led to a series of rating downgrades for property financiers, including Indiabulls Housing Finance Ltd. and Reliance Home Finance Ltd.

Mumbai-based Altico plans to ask lenders for time to map out a plan to repay debt, the company said. The company has just 2 billion rupees of cash on its books and has about 14 billion rupees of debt due by Oct. 12.

READ: Beleaguered Altico Capital to seek more time to repay $610 million

Clearwater Capital Partners, Varde Partners and Abu Dhabi Investment Council are the top investors in the company.

To contact the reporter on this story: Rahul Satija in Mumbai at rsatija1@bloomberg.net

To contact the editors responsible for this story: Shamim Adam at sadam2@bloomberg.net, Stanley James

©2019 Bloomberg L.P.