Asia Stocks to Track US Rebound on Profit Optimism: Markets Wrap

European stocks rose for a second day after strong earnings from some of the region’s biggest companies, while positive economic data helped boost sentiment.

Latest Videos

The information you requested is not available at this time, please check back again soon.

European stocks rose for a second day after strong earnings from some of the region’s biggest companies, while positive economic data helped boost sentiment.

Taylor Wimpey Plc is failing to see lower mortgage rates translate into higher levels of home sales and is maintaining its forecast for fewer deals in 2024.

Chinese mainland investors increased their portion of total turnover of Hong Kong stocks to a record daily average in April, with the latest measures to bolster the city’s position potentially boosting their purchases.

Zhao Xiaowei did what would have been unthinkable just a few years ago: He quit his Beijing barista job and returned to his northeastern rust-belt hometown for a better future.

South Korea is emerging as a closely watched weak link in the $63 trillion world of shadow banking.

May 8, 2019

, Bloomberg News

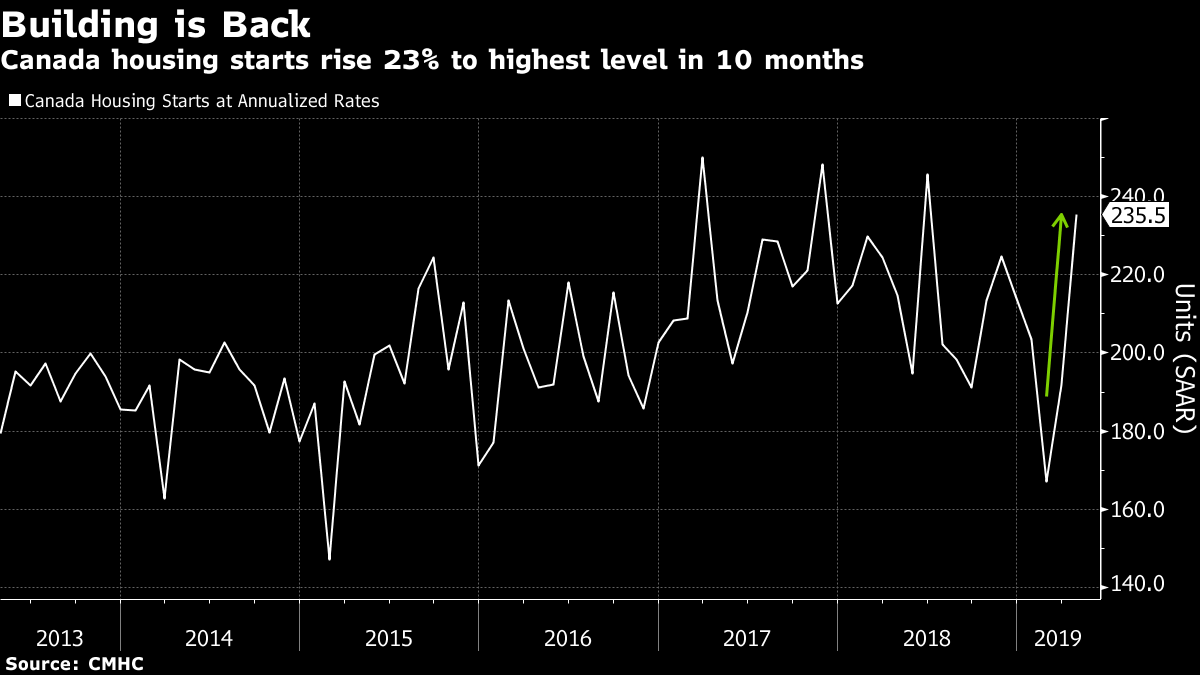

Canadian housing starts unexpectedly surged in April, in another sign of recovery for the nation’s battered real estate market.

Builders started work on an annualized 235,460 units last month, the highest level in 10 months and up 23 per cent from 191,981 units in March, the Canada Mortgage and Housing Corp. reported Wednesday. The gain was driven by new multi-unit construction in Toronto and Vancouver.

The report is in line with other recent data that suggests the nation’s housing sector is stabilizing from a recent slump, easing concerns that some of the country’s more expensive markets like Toronto and Vancouver were poised for a major correction.

Earlier this week, Bank of Canada Governor Stephen Poloz said he’s confident housing will return to growth later this year, once some of the “froth” in those two markets dissipates.

“The Bank of Canada will take this as a factor supporting its forecast for a rebound in housing activity,” Royce Mendes, an economist at CIBC Capital Markets, said in a note to investors.

The level of new building in April is well above recent averages, with economists anticipating housing starts at 195,500 during the month.

Housing markets in Toronto and Vancouver had cooled considerably last year as officials tightened mortgage regulations, imposed taxes on foreign buyers and took other measures designed to curb runaway prices -- raising worries the steps had gone too far.

Fundamentals Strong

Yet economic fundamentals -- everything from strong employment gains to a sharp increase in immigration -- remain supportive, as has the dovish tilt globally from central banks that have helped bring down borrowing costs in recent months.

Poloz cited data in a speech on Monday that showed the Bank of Canada’s five interest rate increases since 2017 are having little impact on borrowing costs for mortgage renewals this year, largely because of a recent drop in global bond yields.

Multiple-unit urban starts were up 30 per cent to an annualized 175,732 units, while single-detached starts in urban centers were up 6 per cent, CMHC said in its release. Vancouver recorded a 63 per cent increase last month, while new home starts in Toronto were up 18 per cent.

Builders also had been holding back construction earlier this year because of excessively cold weather. New home starts slumped to 166,290 units in February -- the lowest monthly level in three years -- as chilly weather slowed construction.