May 5, 2019

Coal’s Future Is in the Hands of the People, Not Banks

, Bloomberg News

(Bloomberg Opinion) -- Climate change is at the top of many American voters’ minds, as evidenced by a CNN poll last week that found “96% of Democrats and Democratic-leaning independents say it's very or somewhat important for a presidential candidate to promise aggressive action” on the issue. At the same time on the other side of the globe, “Promises to fight the world’s most toxic air have made it to the manifestos of major political parties for the first time in Indian elections.” And in the U.K., the Committee on Climate Change recently said the U.K. can “end its contribution to global warming within 30 years by setting an ambitious new target to reduce its greenhouse gas emissions to zero by 2050.”

However, many governments — as well as a number of financial institutions — maintain faith in the need for an expansion of coal-fired power, one of the biggest contributors to global warming. A new survey shows the challenges that commitment will face within some major markets, and they will underpin any coal growth story.

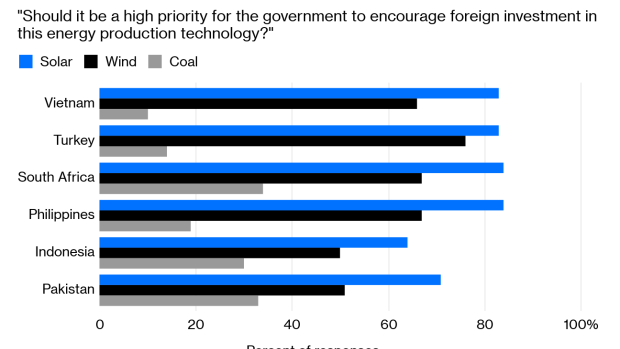

The study, commissioned by think tank E3G, polled citizens in Indonesia, Pakistan, the Philippines, South Africa, Turkey and Vietnam on their preferences for foreign investment in the energy sector. In every country, renewable energy was the top choice.

That finding alone should make policy makers interested in coal — and the international lenders who would finance any new coal-related development — pay attention. Nick Mabey, the co-founder and CEO of E3G, said as much in a tweet:

International investors in coal (and you know who you are) often claim that they are only funding the projects that countries want. So we asked YouGov to pool the public in key recipient countries & it turns out they want clean energy not coal.

There’s more to it than that, though. It’s worth unpacking the survey’s data further, as they offer the public’s clear preferences to policy makers and international investors.

First, the public views coal as a low priority for foreign investment – and not just a low priority, but also much lower than either solar (the top priority in every country polled) or wind. In no country is coal even close to either renewable technology.

Second, while the public associates foreign investment in coal as bad both locally and globally, it’s the local impacts that are perceived as more significant almost everywhere. Climate change and global warming are global, while air and water pollution are local. It’s those local impacts that are viewed more strongly in every country save the Philippines and Indonesia.

In economic terms, coal again fares poorly. In no country did the majority of respondents think coal is good for their economy; likewise, coal trails far behind wind and solar energy in terms of being good for the economy.

Finally, coal isn’t seen as the same job creator as wind and solar energy in any of the countries polled.

Since the beginning of the year, four Asian banks have announced restrictions on financing new coal plants. E3G’s survey may be of interest to other banks with designs on coal-related investment in Asia and other fast-growing, energy-hungry regions. Don’t ask leaders or lenders about coal’s future. Ask the people.

Reading for the week ahead

- NASA says metals fraud caused two satellite launch missions to fail, resulting in more than $700 million in losses.

- Melinda Gates says her greatest regret was developing Microsoft’s Clippy.

- The John Bates Clark medal, awarded to one economist under 40 every year, almost never goes to a macroeconomist. Noah Smith says that Emi Nakamura, this year’s recipient, is a worthy exception.

- Leonid Bershidsky says the “small but established market in weather ETFs” shows why it is smart to bet on climate science.

- Japanese auto supplier Denso, which is “certainly concerned about the projected future decline of new car sales in the United States,” has invested in Bond Mobility, an electric-bike sharing company.

- In an interview with Bloomberg News’s Yoolim Lee, iPhone co-creator and Nest founder Tony Fadell says he is excited about batteries, fintech and food … and that he leaves China investment to the experts.

- Rhode Island’s governor is using her venture capital experience to boost the state’s economy.

- San Francisco’s hottest new co-working spot, WePark, is a street parking space near the city’s Civic Center. It costs $2.25 per hour.

- Los Angeles has launched its own Green New Deal, targeting carbon neutrality by 2050.

- California’s population growth is the slowest in recorded history.

Get Sparklines delivered to your inbox. Sign up here. And subscribe to Bloomberg All Access and get much, much more. You’ll receive our unmatched global news coverage and two in-depth daily newsletters, the Bloomberg Open and the Bloomberg Close.

To contact the author of this story: Nathaniel Bullard at nbullard@bloomberg.net

To contact the editor responsible for this story: Brooke Sample at bsample1@bloomberg.net

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Nathaniel Bullard is a BloombergNEF energy analyst, covering technology and business model innovation and system-wide resource transitions.

©2019 Bloomberg L.P.