Sep 6, 2019

Coffee Snobs Are Shelling Out $3.25 for a Jolt of Instant

, Bloomberg News

(Bloomberg) -- Benji Walklet recently reviewed the instant java sold by Los Angeles startup Waka Coffee. Walklet, who runs the Coffee Concierge blog, liked it but got a second opinion from a trusted critic—his wife, who has been known to compare coffee she doesn’t like to gasoline. “It passed my wife’s taste test,” he says, “and that’s really saying something.” Walklet typically drinks the real thing but stocked up on a 35-serving pack of Waka instant. “If the day gets off to a slow start or we’re in a hurry, it’s great to have instant coffee,” he says. “I wouldn’t buy Nescafe or Folgers or Maxwell House. That’s the snob in me talking.”

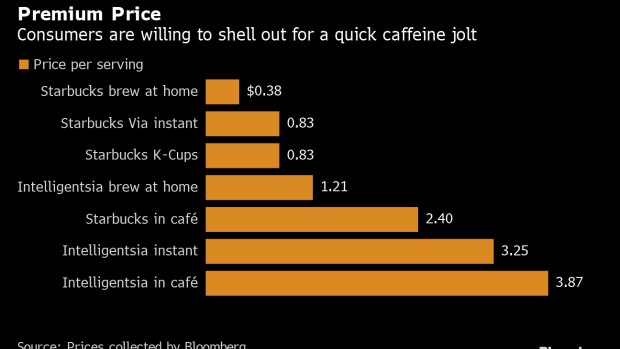

Instant coffee, often relegated to brownie recipes and steak rubs, is making a comeback and even winning grudging approval from connoisseurs. A handful of startups including Waka, Sudden Coffee and Swift Cup Coffee have improved the taste and are attracting a new generation of convenience seekers who are too young to associate the product with the stuff their grandparents drank. They don’t mind paying up either: A Sudden four-pack sold at the Chicago-based coffee chain Intelligentsia goes for $13, or about $3.25 a serving.

Instant remains a niche product, with just 6% of Americans drinking it, according to the National Coffee Association. But U.S. retail sales of the category rose in the year ended in June—the first gain following at least three years of declines, according to Nielsen data. Rising sales and instant’s popularity among 18- to 39-year-olds have prompted industry stalwarts Starbucks Corp. and Dunkin’ Brands Group Inc. to re-evaluate the category.

“Instant is super convenient and portable,” says Jim Watson, a beverage analyst at Rabobank. “You can throw a couple in your bag and travel everywhere. Instant has always been weighed down by being seen as a really low-end product. These specialty guys are making instant coffee cool again.”

Developed by Nestle SA last century, instant coffee was made by spraying brewed liquid into hot air and drying it into powder or granules. Nestle, Folgers and Maxwell House quickly became the go-to brands for middle class people around the world. A Folgers television commercial from that era featured a husband complaining about his wife’s coffee. “Honey, your coffee is undrinkable,” he says. Later, she serves him a cup of Folgers, and marital harmony is restored. “Instant Folgers,” an announcer says. “Tastes good as fresh-perked.”

For those who had tried the real thing, instant coffee lacked the body and flavor of a quality cup of Joe. No matter, Americans were hooked on convenience. Making instant involved nothing more than spooning crystals into a mug and adding boiling water—then maybe whitening the concoction with a powdered creamer.

Everything changed when Starbucks created the cafe culture in the 1990s and popularized Arabica beans—the premium variety. A snob ethos took hold, and consumers thought nothing of paying $3 or more for a cup of coffee. In 1998, Keurig K-Cups—or single-use pods—entered the mix. It wasn’t quite instant, but provided a popular way for time-pressed people to brew fast.

Instant was re-imagined 10 years ago, when Starbucks introduced Via Ready Brew packets in an effort to sell more coffee in grocery stores. Via was made with 100% Arabica beans, cost less than $1 per cup and appealed to people on the go. Sales have been steady but have never really taken off, says John A. Quelch, dean of the Miami Business School at the University of Miami, who has done Starbucks case studies. “They didn’t put a tremendous amount of marketing muscle behind it,” he says.

With K-Cup growth slowing and Starbucks not pushing Via hard, a host of small players have emerged, employing new methods they say produce better-tasting instant. They typically freeze-dry Arabica beans and sell their wares online or in specialty coffee shops.

Sudden was co-founded by a Finnish barista named Kalle Freese, who pioneered a technique in San Francisco that involves lowering the temperature of brewed coffee to -20 degrees Fahrenheit then heating it slightly to let the water vaporize. The traditional heating method can taste “woody and burnt,” says Sudden Chief Executive Officer Josh Zloof. “There’s no reason from a science perspective why instant coffee has to taste bad.”

Sudden, sold in plastic tubes containing 4.5 grams of coffee, can be mixed with hot or cold water. The company avoids the “I” word, choosing to describe the product as “crystallized” rather than instant coffee. The four-year-old startup has raised $5 million and is looking for more funding to ramp up capacity. Zloof says he’s had talks with bigger companies and that it’s just a matter of time before Sudden inks partnerships.

He says quality instant solves the “second-cup” problem—when people are looking for an afternoon caffeine fix but don’t necessarily want to head to Starbucks or drink office-provided K-Cups or Nespresso pods. “It’s not really replacing lower-quality instant coffee,” Zloof says. “It’s also not really replacing going to the cafe or the morning ritual.”

David Kovalevski, who started Waka last year, says his products have landed in “best instant coffee” lists from major coffee publications and is confident sales will improve as his company educates consumers about the merits of instant coffee and differentiates itself from traditional brands.

Instant’s growing popularity has prompted big brands to take a second look. Dunkin’ executives are taste-testing new prototypes and working with partners to create instant varieties to offer in its stores. “The quality has gotten significantly better,” says Dunkin’ CEO Dave Hoffmann. “Before any of that you’d probably rub it on your steak and put it on the grill. You wouldn’t drink that.”

Starbucks, meanwhile, is looking to jumpstart growth for Via with new flavors such as blonde roast, iced coffee and pumpkin-spice latte. The company is working on “more innovation to the Via brand in the near future,” a spokeswoman says, noting that the line is luring Keurig loyalists, along with more “mainstream” roast and ground customers.

Bailey Manson never thought he’d be selling instant coffee when he joined Intelligentsia seven years ago. “We were naysayers for quite a while,” says the coffee chain’s education and service program manager. Then last year, Intelligentsia teamed up with Sudden to freeze dry a variety of single-origin coffee from Colombia. It sold out, despite the hefty price. “What you’re paying for is the convenience,” Manson says. “Nobody wants to go get coffee and have it be hard.”

To contact the author of this story: Leslie Patton in Chicago at lpatton5@bloomberg.net

To contact the editor responsible for this story: Robin Ajello at rajello@bloomberg.net

©2019 Bloomberg L.P.