Nov 21, 2022

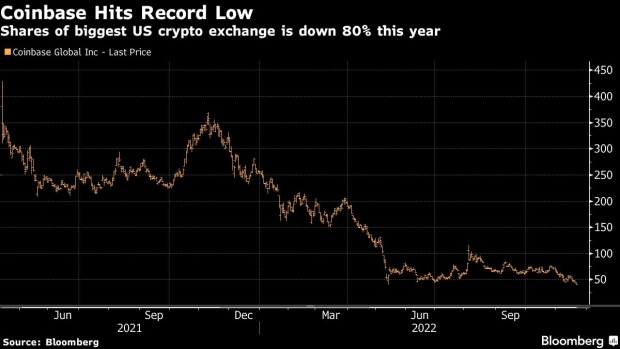

Coinbase Hits Record Low as Crypto Contagion Anxiety Intensifies

, Bloomberg News

(Bloomberg) -- Coinbase Global Inc. shares hit an all-time low amid rising investor skittishness over how far the fallout from rival exchange FTX’s insolvency might spread.

The largest US cryptocurrency exchange’s stock dropped as much as 10.3% to $40.61 before closing down 9% on Monday, leading other crypto-related shares lower. Year-to-date, Coinbase’s shares have plunged more than 80%, while cryptocurrency bellwether Bitcoin is down 65%. Coinbase shares reached a high of $429.54 in April 2021 after making their debut on the Nasdaq.

The drop aligns with a downturn in digital asset prices, which have fallen after the collapse of Sam Bankman-Fried’s crypto empire. Bitcoin dropped as much as 4.1% to $15,589 on Monday, just short of a two-year low hit on Nov. 9. The token has tumbled around 75% from a record high of almost $69,000 reached about a year ago. Also on Monday, Ether dropped as much as 5.5%.

Shares of Marathon Digital Holdings Inc, MicroStrategy Inc., Riot Blockchain Inc. and Core Scientific Inc. all respectively dropped by as much as 10% as well.

“If the $15,500 level breaks for Bitcoin, there is not much support until the $13,500 level, followed by the psychological $10,000 level,” wrote Ed Moya, senior market analyst at Oanda.

Coinbase has 14 buy, 12 hold, and 6 sell ratings. On Friday, Bank of America downgraded Coinbase to neutral from buy.

“We feel confident that COIN is not ‘another FTX,”’ wrote analyst Jason Kupferberg in a note. “But that does not make them immune from the broader fallout within the crypto ecosystem.”

Meanwhile, Cathie Wood’s Ark Investment Management funds have purchased more than 1.3 million shares of Coinbase since the start of this month.

(Adds the closing share price in the second paragraph.)

©2022 Bloomberg L.P.