Michelin Guide Awards Its First Hotel Keys in the US

Eleven hotels earned the top three-key distinction, in a list that focused on major markets rather than being truly comprehensive.

Latest Videos

The information you requested is not available at this time, please check back again soon.

Eleven hotels earned the top three-key distinction, in a list that focused on major markets rather than being truly comprehensive.

Blackstone Inc. and KKR & Co. mortgage real estate investment trusts are grappling with deteriorating office loans as higher interest rates and weak demand drive down property values.

Bank of Canada officials said monetary policy easing is expected to be “gradual,” as they debate the timing of a pivot to rate cuts.

Recovering risk appetite and tightening spreads in the commercial real estate market mean active managers have to work a little harder, according to DoubleLine Capital LP.

Iceland’s inflation eased to the slowest pace in more than two years, suggesting its central bank is more likely to begin reducing the western Europe’s highest interest rate in the coming months.

Jul 17, 2019

, Bloomberg News

(Bloomberg) -- Tom Barrack’s Colony Capital Inc. is exploring the sale of Colony Industrial, its unit that owns warehouses, according to people with knowledge of the matter.

Colony Capital, which in February said it would conduct a strategic review as it attempts to salvage its sinking market value, is working with Eastdil Secured to solicit interest from potential buyers for the unit, which may fetch more than $5 billion, said the people, who asked not to be identified because the talks are private. A representative for Los Angeles-based Colony Capital declined to comment.

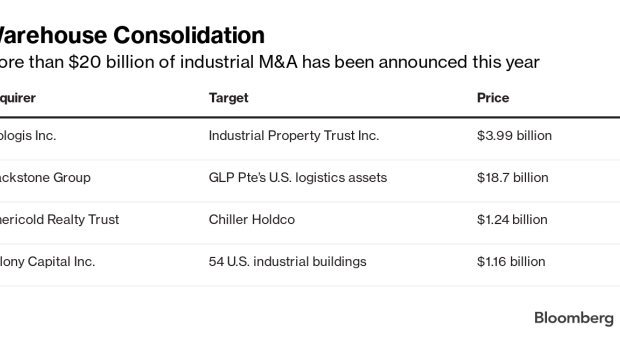

Colony Industrial, based in Dallas and led by Lew Friedland, has been growing. In March, it bought a portfolio of 54 buildings spanning 11.9 million square feet (1.1 million square meters) across states including California, Washington and Oregon for almost $1.2 billion.

The unit’s holdings are mostly light industrial properties, which serve as the last mile of the logistics chain and are crucial for companies seeking to make speedy deliveries to consumers. The business’s assets were worth about $4.3 billion as of March 31, according to filings. Including interests held off-balance sheet, this number exceeds $5 billion, according to one of the people.

The warehouse business was one of a few that was discussed when Colony Capital held preliminary talks with Oaktree Capital Group LLC late last year, Bloomberg has reported. Because of relatively strong growth and low vacancies, warehouses have remained in favor with real estate investment trusts such as Prologis Inc. and private equity firms including Blackstone Group Inc. Both companies struck large industrial deals in recent months.

Real estate investor Colony Capital, which manages $43 billion, has been struggling to bounce back from a calamitous January 2017 merger with two NorthStar companies. Since the deal’s completion, its stock had fallen roughly 65% through Tuesday. The shares, which were trading as low as $4.99 earlier Wednesday, jumped to as high as $5.15 after Bloomberg reported the company was exploring a sale of the industrial unit. They traded at $5.04 at 1:53 p.m. in New York.

Barrack, who was chairman of Trump’s inauguration committee, returned to the chief executive officer role at Colony last November.

One of Colony’s affiliates, NorthStar Realty Europe Corp., agreed earlier this month to be acquired by Axa Investment Managers.

(Updates with share reaction in sixth paragraph.)

--With assistance from Lily Katz.

To contact the reporter on this story: Gillian Tan in New York at gtan129@bloomberg.net

To contact the editors responsible for this story: Alan Goldstein at agoldstein5@bloomberg.net, Daniel Taub, Steve Dickson

©2019 Bloomberg L.P.