Sep 27, 2020

Commerzbank Picks Deutsche Bank’s Knof as CEO to Drive Overhaul

, Bloomberg News

(Bloomberg) -- Commerzbank AG passed over internal frontrunners in favor of an executive with a reputation for tough cuts at its biggest rival to push through one of the largest restructuring programs in its history.

Manfred Knof, 55, head of German retail banking at Deutsche Bank AG, takes over from Martin Zielke as Commerzbank chief executive officer on Jan. 1, according to a statement this weekend. His main task: overseeing a turnaround that may lead to about 10,000 jobs cuts, Bloomberg News has reported.

“Manfred Knof is an experienced and highly effective top manager who has proven himself in a wide range of tasks in the financial services industry,” Commerzbank Supervisory Board Chairman Hans-Joerg Vetter said in a press release late Saturday. “He brings the necessary expertise and human leadership skills for the tasks that lie ahead of the bank.”

The new CEO ends a crisis that erupted when Zielke and Vetter’s predecessor, Stefan Schmittmann, announced their resignation in July. Their departures followed months of criticism from the lender’s main shareholders -- the German government and Cerberus Capital Management -- of the bank’s poor performance and lack of direction.

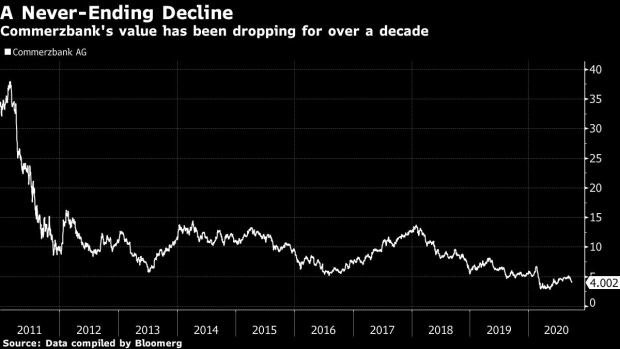

The lender’s share price hit an all time low of 2.80 euros earlier this year, continuing a slide that had worsened in the aftermath of the financial crisis and far from the 229 euro all-time high set in 2007.

The German government, which bailed Commerzbank out during the crisis, would need a share price of approximately 24 euros to break even on its investment. Cerberus bought its stake when the stock was trading at about 9.40 euros, while the shares closed at 4 euros apiece on Friday.

Commerzbank is working on a new strategy to boost returns by shuttering as many as 800 retail branches and scale back the bank’s foreign presence in addition to job cuts. Knof’s appointment may mean the bank can now move swiftly to adopt and present the new strategy.

One of two government representatives on the supervisory board, Jutta Doenges, led the search for the new chairman during the summer. Once installed, Vetter’s first important task was to find a new CEO. Doenges and Cerberus support Knof, people familiar with their thinking said.

In choosing Knof, Vetter decided to pass over two senior executives seen as potential Zielke successors -- Chief Financial Officer Bettina Orlopp and corporate clients head Roland Boekhout. Boekhout was initially considered the leading candidate before Vetter joined. The chairman then preferred an external candidate, according to people familiar with the matter.

Knof’s appointment comes 18 months after Commerzbank held unsuccessful merger talks with Deutsche Bank. One of the main ideas behind the union would have been to achieve deep cost cuts at their combined retail units, thanks to massive overlaps in branches and back office.

According to Bloomberg Intelligence analyst Philip Richards, a tie-up with Deutsche Bank may still be the ultimate outcome for Commerzbank if it fails to lift profitability as a standalone entity. Commerzbank could report losses for this year and next, he said in a note earlier this month.

Knof joined Deutsche Bank only one year ago to head the German retail unit where he oversaw the merger of the two formerly separate retail divisions, which was completed in May. He also recently sought to speed up cost cuts after falling behind internal planning partly due to the coronavirus pandemic leading to a suspension of layoffs earlier this year, people familiar with the matter have said.

He told people around him last year that he was dissatisfied in his role. His role at Germany’s biggest lender will be assumed by his current boss, Deputy CEO Karl von Rohr, a spokeswoman said.

Knof led the German business of the insurance company Allianz AG, where he “comprehensively digitalized the business” and “steered Allianz’ turnaround program,” according to the press release. He also worked at Dresdner Bank before it was later acquired by Commerzbank and led its retail unit in southern Germany.

(Adds details about Commerzbank’s historic share price development in fifth and sixth paragraph)

©2020 Bloomberg L.P.