Sep 23, 2022

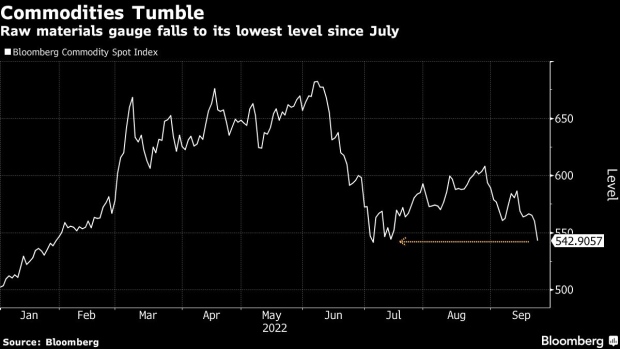

Commodities Gauge Slumps to Lowest Since July Amid Broad Selloff

, Bloomberg News

(Bloomberg) -- A key gauge for commodities prices has sunk to a two-month low as investors rushed to shed risk assets amid mounting fears of a global recession.

The Bloomberg Commodity Spot Index, which tracks futures contracts for everything from oil to copper and cotton, settled 3.1% lower on Friday to a level not seen since July. The measure has lost more than 20% since peaking in June.

Global inventories for many raw materials remain tight in the face of robust demand. Still, investors everywhere are increasingly worried that substantial increases in interest rates by the Federal Reserve and other central banks as part of their efforts to rein in the highest inflation in decades will throw the global economy into recession.

What’s more, the dollar’s march to record highs is a drag on commodities priced in the greenback because it reduces other currencies’ buying power, further eroding the demand outlook.

A significant retreat in commodities prices -- including fuel, food staples and construction material -- would come as a relief for consumers after costs for everything surged in the aftermath of the pandemic.

©2022 Bloomberg L.P.