Mar 19, 2023

Commodities Show Cautious Return to Risk on Credit Suisse Rescue

, Bloomberg News

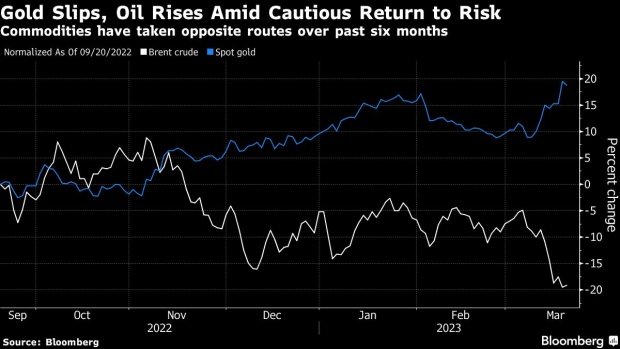

(Bloomberg) -- Many commodities remained under pressure in the wake of UBS Group AG’s emergency purchase of Credit Suisse Group AG that aims to contain a banking crisis hurting the appeal of risk assets.

Oil sank, with the US benchmark plunging below $65 a barrel to the lowest since late 2021. Grains fell and European gas hit the lowest in more than 1 1/2 years, though copper rose amid a mixed session for industrial metals. Gold — which benefited from the banking turmoil with a 6.5% surge last week — eased after topping $2,000 an ounce for the first time in a year on haven demand.

After reaching a record last year following Russia’s invasion of Ukraine, the Bloomberg Commodities Spot Index has dropped by more than a quarter as concerns over a global slowdown, higher interest rates, and a huge selloff in natural gas dragged the gauge lower. The upheaval in the banking sector — marked by the swift collapse of several US lenders and subsequent crisis at Credit Suisse — then deepened the rout, although bullion was a beneficiary.

With a crisis of confidence threatening to spread across financial markets, the Swiss government brokered the deal for Credit Suisse over the weekend, including a guarantee for potential losses from the assets UBS is taking over. The Federal Reserve and five other central banks also announced coordinated action to boost liquidity in US dollar swap arrangements to ease strains in the financial system.

Following those efforts, financial markets came under further pressure early Monday before equities started to fare better.

“When banking suffers then credit suffers and then the economy suffers,” said Bjarne Schieldrop, chief commodities analyst at SEB AB. “So less optimism on economic growth is warranted.”

- Click here for a Top Live Blog on the crisis.

The trajectory for raw materials this week will mostly hinge on how the Credit Suisse deal is received, as well as on the outcome of the Fed’s rate decision on Wednesday. Although US policy makers had signaled their willingness to raise rates by 50 basis points to contain still-hot inflation before the banking crisis erupted, market watchers now expect a smaller increase, or perhaps even a pause.

The worries over the banking sector have prompted Goldman Sachs Group Inc. — one of the most bullish banks on crude — to trim its forecasts, with the lender no longer seeing prices at $100 in the year ahead. That’s even with it now expecting OPEC producers to only increase output in the third quarter of 2024, rather than in the second half of 2023.

Oil Spread Slumps Most Since January in Latest Sign of Weakness

“Participants are still not fully convinced on whether recent moves by authorities can backstop further banking fallouts,” said Yeap Jun Rong, a market strategist at IG Asia Pte in Singapore. Investors are now wondering whether to buy the dip, Yeap said.

Bullion’s Appeal

Gold’s jump last week was its biggest since the early days of the pandemic. Heading into the latest banking crisis, precious metals were dramatically under-owned after a big selloff in February, said Ole Sloth Hansen, head of commodities strategy at Saxo Bank A/S. A shift to a more dovish outlook from Fed policy makers would benefit non-yielding bullion.

In other commodities, iron ore fell after Chinese regulators renewed warnings to companies against hoarding and price gouging in response to a recent surge in the steel-making material. Wheat retreated after the renewal of a deal allowing Ukraine to ship rains and other crops from key Black Sea ports, although there was uncertainty over the length of the agreement.

Five Key Charts to Watch in Global Commodity Markets This Week

--With assistance from Winnie Zhu, Yongchang Chin, Paul Burkhardt, Paul Wallace and Eddie Spence.

©2023 Bloomberg L.P.