Apr 19, 2022

Commodities Trader Gunvor Doubled Profit on Hot Gas Market

, Bloomberg News

(Bloomberg) -- Gunvor Group said net profit more than doubled last year thanks in large part to booming natural gas markets.

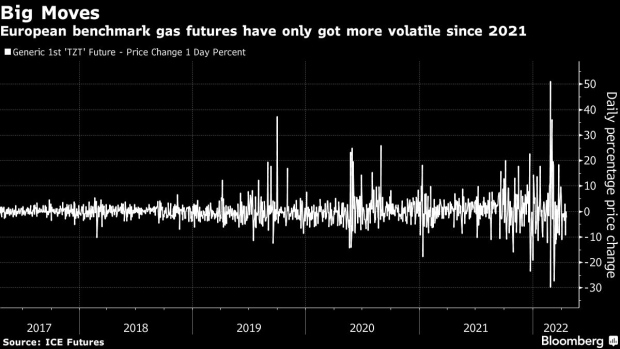

Gunvor is the latest commodity trader to announce bumper earnings as the global economic rebound from the pandemic boosted demand for energy, metals and food. Now, increased market volatility from the war in Ukraine is providing trading houses with further opportunities, while forcing them to scramble for cash as liquidity pressures build.

Gunvor and some rivals are trimming the size of their trading books, Chief Financial Officer Muriel Schwab said last month. The company said on Tuesday that it maintains a healthy liquidity position.

The firm’s profit of $726 million last year was the highest since 2015, when the Geneva-headquartered company generated significant income from the sale of Russian energy assets. Traders took advantage of market volatility to boost profits, but it also contributed to banks increasing margin requirements.

Gunvor entered the international bond market last year for the first time since 2013 after facing huge margin calls when gas prices soared.

Gas and liquefied natural gas trading “generated sustainable earnings throughout the year,” Gunvor said in a statement. The company “continued to strengthen its balance sheet” in 2021, it said.

The volume of commodities Gunvor traded rose 26% to a record 240 million tons in 2021. Bigger volumes and soaring prices meant revenue jumped 170% to $135 billion from 2020.

(Updates with comments on gas trading in fourth paragraph.)

©2022 Bloomberg L.P.