Mar 22, 2023

Commodity Traders Fear Impact From Bank Crisis

, Bloomberg News

(Bloomberg) -- Welcome to Energy Daily, the Bloomberg newsletter you’ve known as Elements. The name is new, but the mission is the same: to be your guide to the energy and commodities markets powering the economy, leveraging the expertise of Bloomberg journalists around the world. Today, we take a look the reaction from Swiss trading houses to the banking crisis. To get Energy Daily in your inbox, you can sign up here.

Trading houses in Switzerland are voicing concerns that the takeover of Credit Suisse Group AG could have a negative impact on their industry.

Major Swiss banks have played a key role in establishing the country as one of the world’s biggest commodities hubs, providing firms with vital credit to procure, store and transport raw materials.

At the FT Commodities Global Summit in Lausanne this week, there’s fear that the recent financial turbulence and the combination of the nation’s two largest banks could restrict those services for smaller traders.

“Genuinely it’s not something we see as a positive at all, anything like this where it impacts the commodity space,” said Craig Dean, the boss of major metals trader Gerald Group. “Credit Suisse is a good commodity bank for us, and we’re hopeful that they just don’t go away.”

If there is an impact, it will be uneven. The largest independent trading houses have access to internationally diverse financial resources. Trafigura Group, for example, has said it used 140 banks in its 2022 financial year.

But smaller players tend to rely on a clutch of key relationships. In the hubs of Geneva, Zug and Lausanne, Credit Suisse, UBS Group AG and the country’s cantonal banks provide a significant chunk of traders’ lines of credit.

“I’m probably more concerned on the trading side for smaller, niche traders or more generally for SME companies in Switzerland which typically rely on those two banks,” said Mercuria Group’s finance chief, Guillaume Vermersch. “They may be more on the spot in the coming few months.”

The availability of trade finance had already diminished over the past few years as major providers ABN Amro Bank NV and BNP Paribas SA pulled back from the sector. With recent consolidation among commodity banks, the loss of Credit Suisse could bring more problems for the smaller trading firms.

--Archie Hunter, Bloomberg News

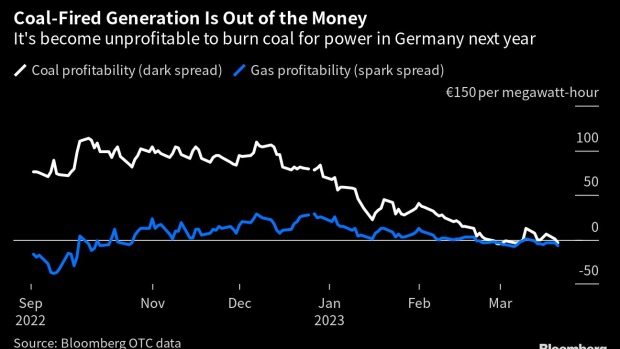

Chart of the Day

Profit is evaporating at Europe’s coal-fired power plants as pollution costs rebound. The declining profitability through most of this month is another nudge for utilities to move away from the dirtiest form of generation as the region seeks to meet emission goals.

Today’s Top Stories

Russia’s Vladimir Putin failed to clinch a deal to sell more natural gas to China during a meeting with Xi Jinping. There was no explicit agreement or even a nod to progress on the Power of Siberia 2 pipeline as Moscow attempts to shift sales from Europe to Asia.

Oil held steady ahead of an interest-rate decision from the Federal Reserve, with West Texas Intermediate futures trading above $69 a barrel. Markets are pricing in a roughly 80% chance that the US central bank will hike rates by a quarter point on Wednesday.

A bomb cyclone slammed into Northern California, packing hurricane-like winds that toppled power lines, shattered windows in downtown San Francisco and caused a rig to overturn on the Bay Bridge to Oakland. A flood advisory is in effect in the Bay Area.

South Korean tycoon Gim Seong-gon, whose CS Wind Corp. spent $150 million to take over the world’s largest wind-tower factory in Colorado in 2021, plans to invest a further $600 million to double the facility’s capacity in a bet on soaring US demand.

A global biofuel boom is set to drive a shortage of vegetable oils — used for cooking and increasingly to power trucks and planes — intensifying a debate over food versus fuel. Demand is so hot that producers are hunting for sludge, a waste product from processing palm oil, as feedstock.

Best of the Rest

- The Center for Strategic and International Studies examines the US Inflation Reduction Act in this commentary, arguing that a potential compromise between pipeline permitting and power-transmission permitting may be needed to build a clean and affordable energy system.

- Euractiv looks at European Union plans to work with nature to tackle climate change. From planting trees to rewetting peatlands, the EU has set targets to restore the natural environment, but it’ll have its work cut out to meet them, reporter Kira Taylor says.

- China energy expert David Fishman of the Lantau Group asks: What does a modern Chinese coal-fired power plant look like? He visited a giant generator in Guangdong to find out, and gives us the highlights in this neat Twitter thread.

--With assistance from Stephen Stapczynski and Liezel Hill.

©2023 Bloomberg L.P.