Dec 13, 2021

Connecticut Pension-Debt Paydown Boosts Bonds, CreditSights Says

, Bloomberg News

(Bloomberg) -- Connecticut’s general obligation bonds are poised to outperform the broader municipal-debt market as surging tax revenue allows the state to chip away at its $41 billion public pension debt, CreditSights Inc. said.

The firm revised its rating on the state’s general obligations to market outperform from market perform before the state’s $800 million bond issue set to price Tuesday.

Connecticut has transferred almost $1.7 billion in surplus cash into its underfunded state employee and teachers’ pension funds in the last two years and it may plow an extra $6.3 billion into the retirement system over the next five years, according to bond offering documents.

“The credit concern people have had with Connecticut is the pension and the size of the liability, and that’s kept their rating low,” said John Ceffalio, senior municipal credit analyst at CreditSights. “To make that extra contribution over and above what the actuaries are requiring is meaningful.”

Connecticut’s rainy-day fund is projected to grow to about $5 billion at the end of the fiscal year in June, enough to cover almost a quarter of general-fund spending, and the state received $2.8 billion under the American Rescue Plan.

Surging stocks and Wall Street profits have boosted capital-gains-tax revenue, while sales-tax collections are also rising. Connecticut is also reaping the reward of booming real estate as New York City residents move to the suburbs amid the pandemic.

Revenue Growth

Overall, state tax revenue grew 12% in fiscal 2021 and is projected to rise 5% this fiscal year, according to CreditSights. The state projects a $900 million budget surplus this year and a $530 million surplus in fiscal 2023.

Growing reserves will help ease the fiscal stress caused by the state’s high debt load and retirement costs. In 2017, lawmakers passed a bill requiring the state, which is heavily reliant on Wall Street for income-tax revenue, to stock its rainy-day fund with any capital-gains and bonus taxes that exceed a certain threshold.

State law caps the budget reserve at 15% of spending, with any excess transferred to pensions.

Connecticut’s State Employees’ Retirement System has a funding ratio of 38.5%, while the teachers’ pension is 51% funded. In comparison, the median public-pension funding level was about 73% in fiscal 2020, according to the National Association of State Retirement Administrators.

Governor Ned Lamont, a Democrat, has put Connecticut on a “debt diet” that’s slowly paying off. The state’s general obligation debt declined to $18.2 billion in 2021 from $18.8 billion in 2020, according to the offering document.

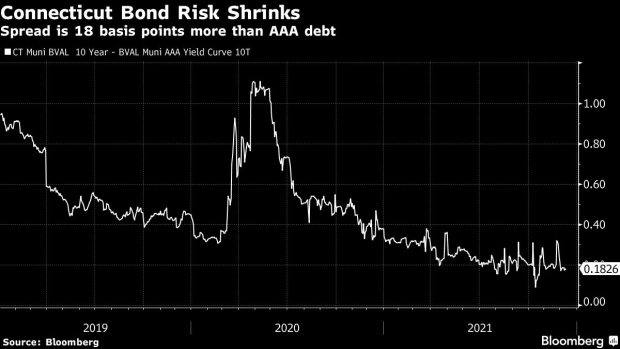

Spread Squeeze

To be sure, there’s not much room for its bonds to outperform. The extra yield investors demand for the risk of holding Connecticut debt maturing in 10 years has plummeted to 0.18 percentage point from 1.1 percentage point in May 2020, data compiled by Bloomberg show.

Only Illinois and New Jersey have wider spreads, at 0.58 percentage point and 0.32 percentage point, respectively.

“We could see over the next year, potentially, some upward movement in the ratings or outlook and that should drive spreads a little tighter,” Ceffalio said.

Fitch Ratings assigns a AA- rating to Connecticut’s general obligation bonds, its fourth-highest investment grade. Moody’s Investors Service gives it a comparable Aa3 rating. S&P Global Ratings ranks it one level lower at A+. The companies all have a stable outlook on the bonds.

©2021 Bloomberg L.P.