Sep 30, 2020

Consolidate or Sell: Docomo Deal Signals More Unwinding in Japan

, Bloomberg News

(Bloomberg) -- The buyout of Japan’s largest publicly traded subsidiary is set to trigger a wave of consolidation of listed units, amid ongoing criticism of the country’s practice of “parent-child” listings.

Nippon Telegraph & Telephone Corp.’s blockbuster $40 billion buyout of its mobile unit NTT Docomo Inc. has put the issue of these corporate structures, in which the parent company and subsidiary are both listed entities, back in the spotlight.

While a rarity in many developed markets, Japan is still home to a flurry of such listings. But after years of complaints from corporate governance experts, the wave of consolidation or sales of these units is gathering pace -- and analysts say the pandemic is likely to accelerate the dealmaking in the months ahead, with tertiary businesses divested to raise cash.

“As companies seek to improve their operating framework, we think they will look first of all at overhauling relationships between controlling shareholding companies and owned companies, including parent/subsidiary listings,” Goldman Sachs analyst Hiromi Suzuki wrote in a note to clients Wednesday. “M&A activity among Japanese companies has been at a standstill of late owing to Covid-19 impact, but we expect activity to catch up quickly as the economy recovers.”

Goldman highlighted some of the largest examples of such cross-shareholdings:

Source: Goldman Sachs, Bloomberg

Softbank Group Corp., itself the subject of discussion over a possible management buyout, has recently further sold down its stake of mobile operator Softbank Corp. It also retains control of Internet conglomerate Z Holdings Corp. Other listed units that have attracted speculation include beermaker Kirin Holdings Co.’s drugmaker unit Kyowa Kirin Co. and retailing giant Aeon Co.’s stakes in a slew of listed companies including drugstore operator Welcia Holdings Co., Aeon Financial Service Co. and Aeon Fantasy Co.

Since companies in Japan tend to pair major announcements with earnings season, the October and November period could see a flurry of such announcements, said Kenji Abe, chief strategist at Daiwa Securities.

“It could be buying out a listed subsidiarity like NTT, or to even selling off a unit if they need cash,” Abe said. “These parent-child structures have become a major business issue because of increasing pressure from institutional investors.”

Abe sees two patterns: share price rises in the units present an opportunity for companies thinking of selling off their subsidiaries, while share declines represent an opportunity for those, like NTT, thinking of consolidating their listed entities.

Toyota Motor Corp.’s holdings in the likes of truckmaker Hino Motors Ltd. and Toyoda Gosei Co. have also led to some suggesting the automaker might be next to reorganize, having previously bought out listed units such as Daihatsu Motor Co.

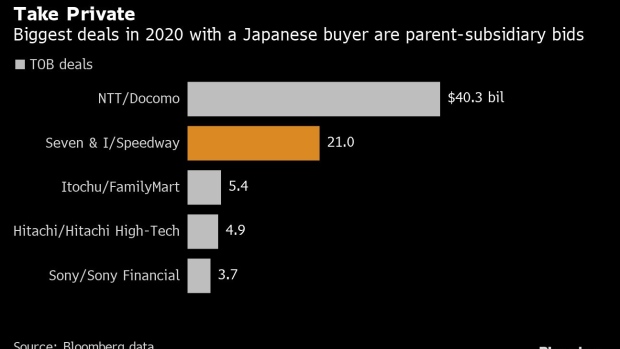

The trend for parent-child listings is already evident from Japan’s M&A activity this year -- deals to take subsidiaries private account for nearly half of the $112.6 billion in deals with a Japanese buyer announced in 2020, according to data compiled by Bloomberg. Four out of the five biggest deals have been such bids to unwind parent-child structures, amounting to around $54.3 billion in value.

In addition to NTT and Docomo, Sony Corp. took its finance unit private for about 400 billion yen ($3.79 billion) earlier this year, while trading firm Itochu Corp. is buying out convenience store chain FamilyMart Co. The only major overseas deal announced this year was convenience store operator Seven & i Holdings Co.’s $21 billion bid for North American gas station chain Speedway.

©2020 Bloomberg L.P.